1.2 — Essential Micro Concepts

ECON 316 • Game Theory • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/gameF21

gameF21.classes.ryansafner.com

Game Theory vs. Decision Theory

The Two Major Models of Economics as a “Science”

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

The Two Major Models of Economics as a “Science”

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Equilibrium

Agents compete with others over scarce resources

Agents adjust behaviors based on prices

Stable outcomes when adjustments stop

Game Theory vs. Decision Theory Models I

Traditional economic models are often called “Decision theory”:

Optimization models ignore all other agents and just focus on how can you maximize your objective within your constraints

- Consumers max utility; firms max profit, etc.

Outcome: optimum: decision where you have no better alternatives

Game Theory vs. Decision Theory Models I

Traditional economic models are often called “Decision theory”:

Equilibrium models assume that there are so many agents that no agent’s decision can affect the outcome

- Firms are price-takers or the only buyer or seller

- Ignores all other agents’ decisions!

Outcome: equilibrium: where nobody has any better alternative

Game Theory vs. Decision Theory Models III

Game theory models directly confront strategic interactions between players

- How each player would optimally respond to a strategy chosen by other player(s)

- Lead to a stable outcome where everyone has considered and chosen mutual best responses

Outcome: Nash equilibrium: where nobody has a better strategy given the strategies everyone else is playing

Equilibrium in Games

- Nash Equilibrium:

- no player wants to change their strategy given all other players’ strategies

- each player is playing a best response against other players’ strategies

Optimization & Preferences

Individual Objectives and Preferences

What is a player's objective in a game?

- “To win”?

- Few games are purely zero-sum

“De gustibus non est disputandum”

We need to know a player's preferences over game outcomes

Modeling Individual Choice

- The consumer's utility maximization problem:

Choose: < a consumption bundle >

In order to maximize: < utility >

Subject to: < income and market prices >

Modeling Firm's Choice

- 1st Stage: firm's profit maximization problem:

Choose: < output >

In order to maximize: < profits >

- 2nd Stage: firm's cost minimization problem:

Choose: < inputs >

In order to minimize: < cost >

Subject to: < producing the optimal output >

Preferences I

- Which game outcomes are preferred over others?

Example: Between any two outcomes (a,b):

Preferences II

- We will allow three possible answers:

Preferences II

- We will allow three possible answers:

- a≻b: (Strictly) prefer a over b

Preferences II

- We will allow three possible answers:

a≻b: (Strictly) prefer a over b

a≺b: (Strictly) prefer b over a

Preferences II

- We will allow three possible answers:

a≻b: (Strictly) prefer a over b

a≺b: (Strictly) prefer b over a

a∼b: Indifferent between a and b

Preferences II

- We will allow three possible answers:

a≻b: (Strictly) prefer a over b

a≺b: (Strictly) prefer b over a

a∼b: Indifferent between a and b

- Preferences are a list of all such comparisons between all bundles

See my ECON 306 class on preferences for more.

So What About the Numbers?

Long ago (1890s), utility considered a real, measurable, cardinal scale†

Utility thought to be lurking in people's brains

- Could be understood from first principles: calories, water, warmth, etc

Obvious problems

† "Neuroeconomics" & cognitive scientists are re-attempting a scientific approach to measure utility

Utility Functions?

More plausibly infer people's preferences from their actions!

- “Actions speak louder than words”

Principle of Revealed Preference: if a person chooses x over y, and both are affordable, then they must prefer x⪰y

Flawless? Of course not. But extremely useful approximation!

- People tend not to leave money on the table

Utility Functions!

A utility function u(⋅)† represents preference relations (≻,≺,∼)

Assign utility numbers to bundles, such that, for any bundles a and b: a≻b⟺u(a)>u(b)

† The ⋅ is a placeholder for whatever goods we are considering (e.g. x, y, burritos, lattes, dollars, etc)

Utility Functions, Pural I

Example: Imagine three alternative bundles of (x,y): a=(1,2)b=(2,2)c=(4,3)

Utility Functions, Pural I

Example: Imagine three alternative bundles of (x,y): a=(1,2)b=(2,2)c=(4,3)

- Let u(⋅) assign each bundle a utility level:

| u(⋅) |

|---|

| u(a)=1 |

| u(b)=2 |

| u(c)=3 |

Utility Functions, Pural I

Example: Imagine three alternative bundles of (x,y): a=(1,2)b=(2,2)c=(4,3)

- Let u(⋅) assign each bundle a utility level:

| u(⋅) |

|---|

| u(a)=1 |

| u(b)=2 |

| u(c)=3 |

- Does this mean that bundle c is 3 times the utility of a?

Utility Functions, Pural II

Example: Imagine three alternative bundles of (x,y): a=(1,2)b=(2,2)c=(4,3)

- Now consider u(⋅) and a 2nd function v(⋅):

| u(⋅) | v(⋅) |

|---|---|

| u(a)=1 | v(a)=3 |

| u(b)=2 | v(b)=5 |

| u(c)=3 | v(c)=7 |

Utility Functions, Pural III

Utility numbers have an ordinal meaning only, not cardinal

Both are valid utility functions:

- u(c)>u(b)>u(a) ✅

- v(c)>v(b)>v(a) ✅

- because c≻b≻a

Only the ranking of utility numbers matters!

Utility Functions and Payoffs Over Game Outcomes

We want to apply utility functions to the outcomes in games, often summarized as “payoff functions”

Using the ordinal interpretation of utility functions, we can rank player preferences over game outcomes

Utility Functions and Payoffs Over Game Outcomes

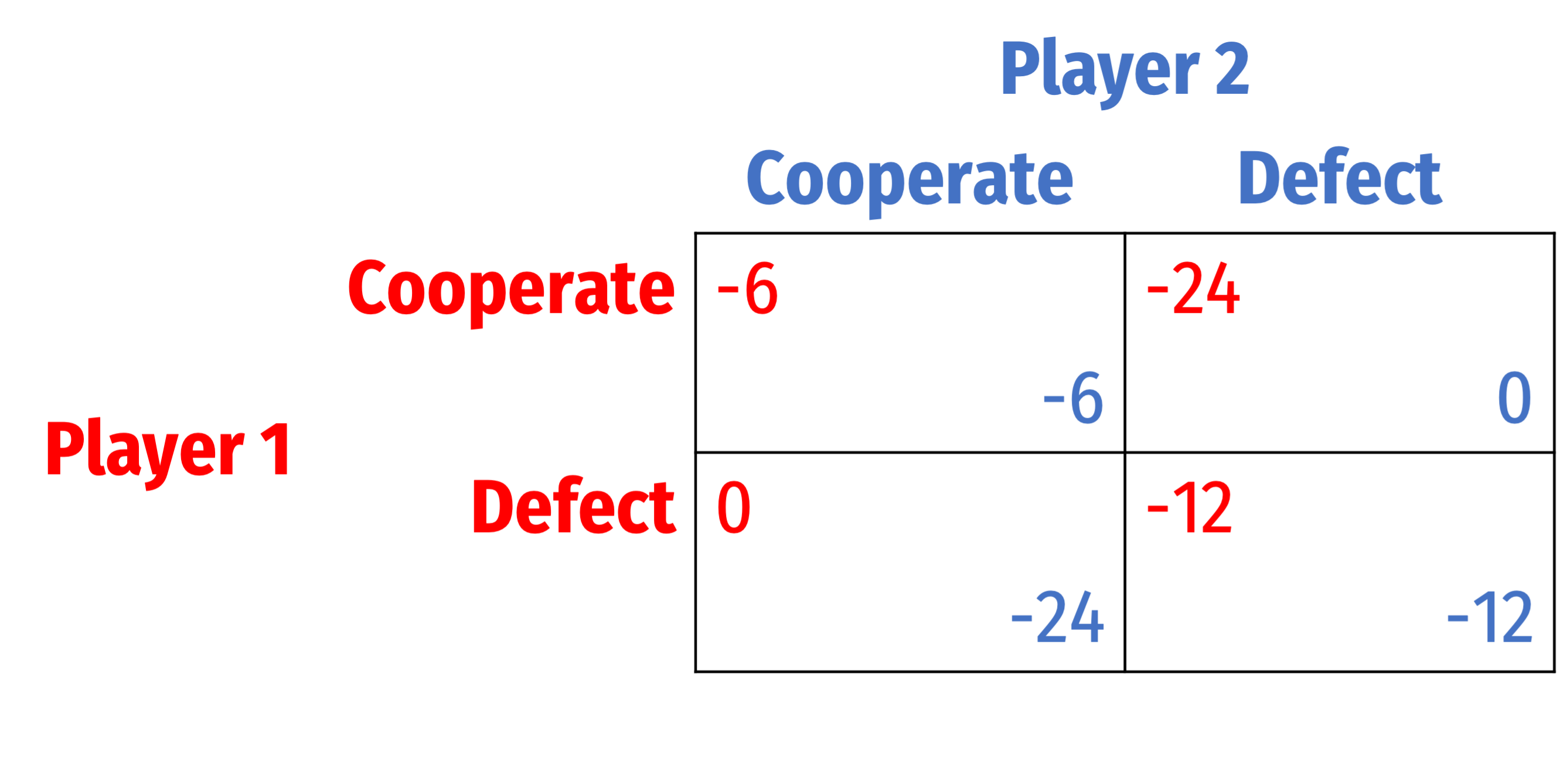

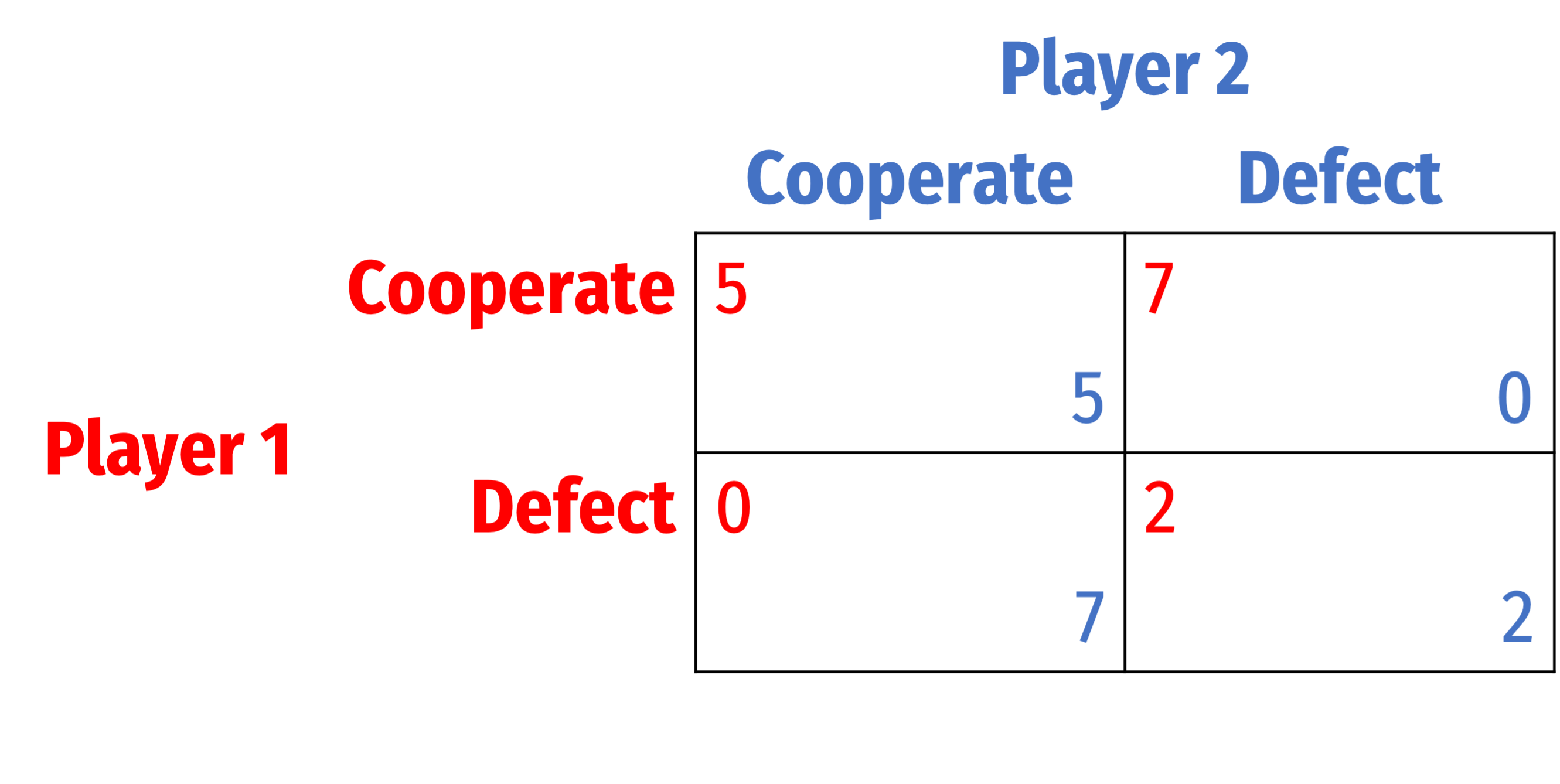

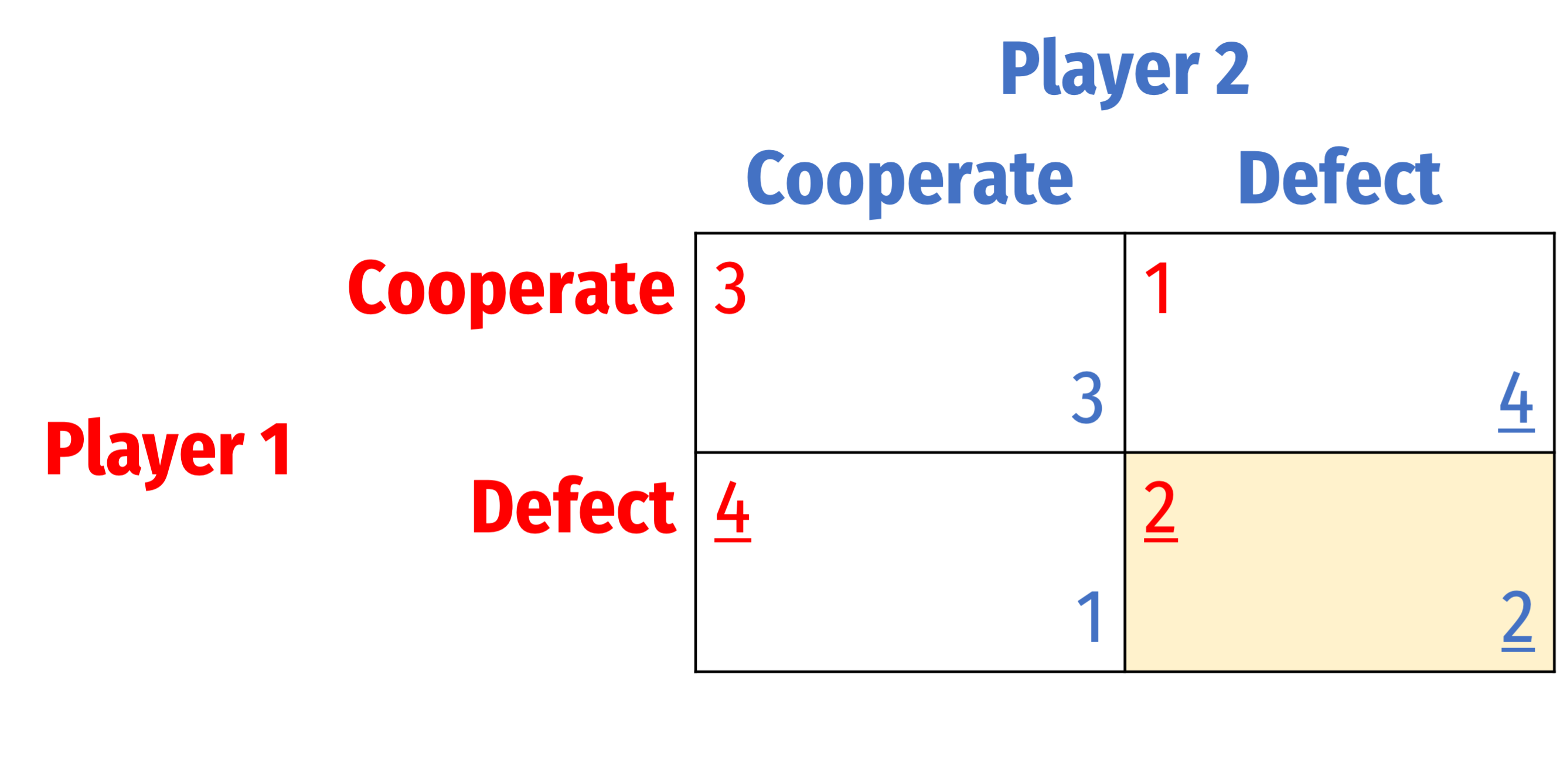

Take a prisoners' dilemma and consider the payoffs to Player 1

u1(D,C)≻u1(C,C)

- 0>−6

- u1(D,D)≻u1(C,D)

- −12>−24

Utility Functions and Payoffs Over Game Outcomes

Take a prisoners' dilemma and consider the payoffs to Player 2

u2(C,D)≻u2(C,C)

- 0>−6

- u2(D,D)≻u2(D,C)

- −12>−24

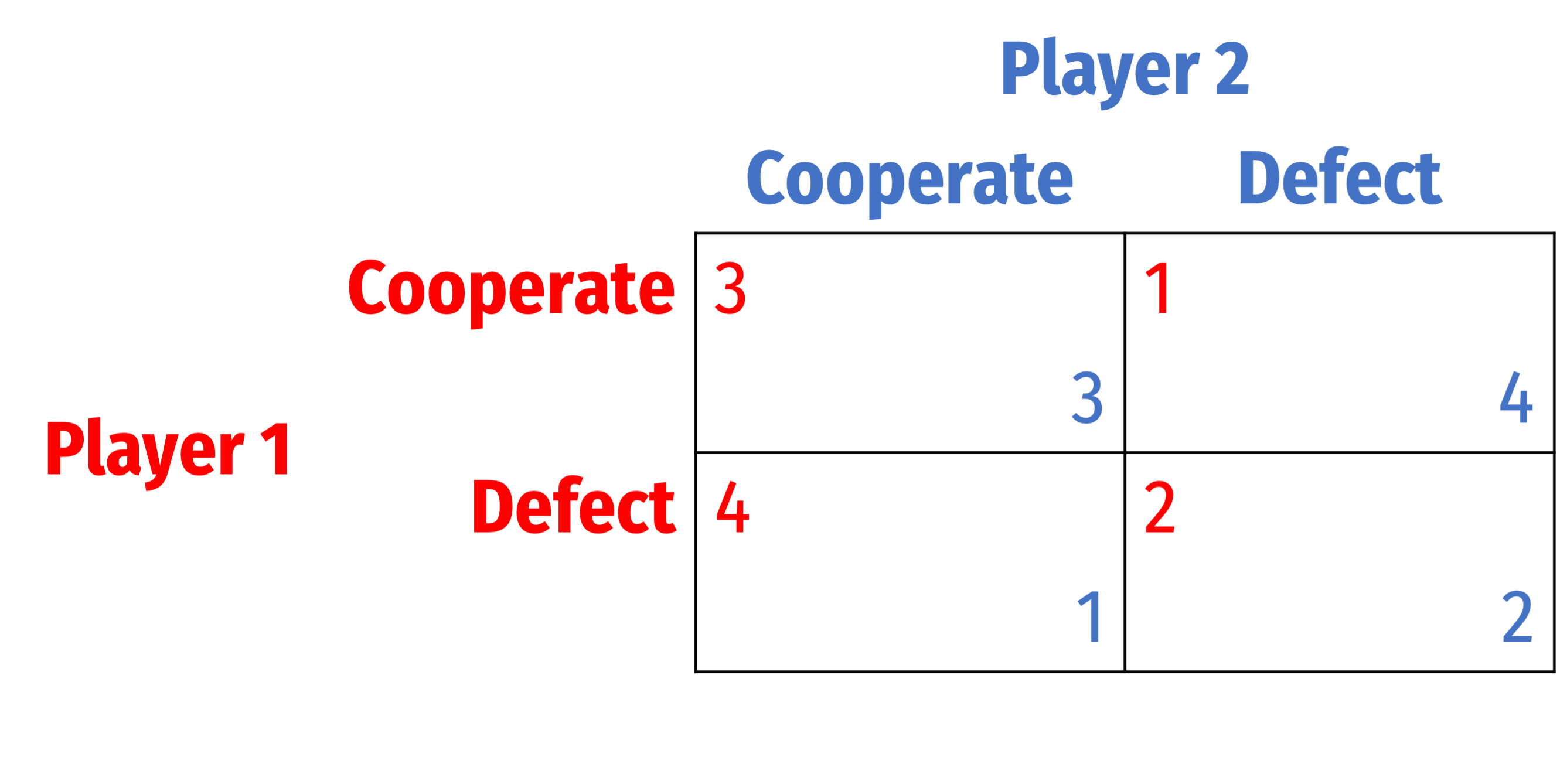

Utility Functions and Payoffs Over Game Outcomes

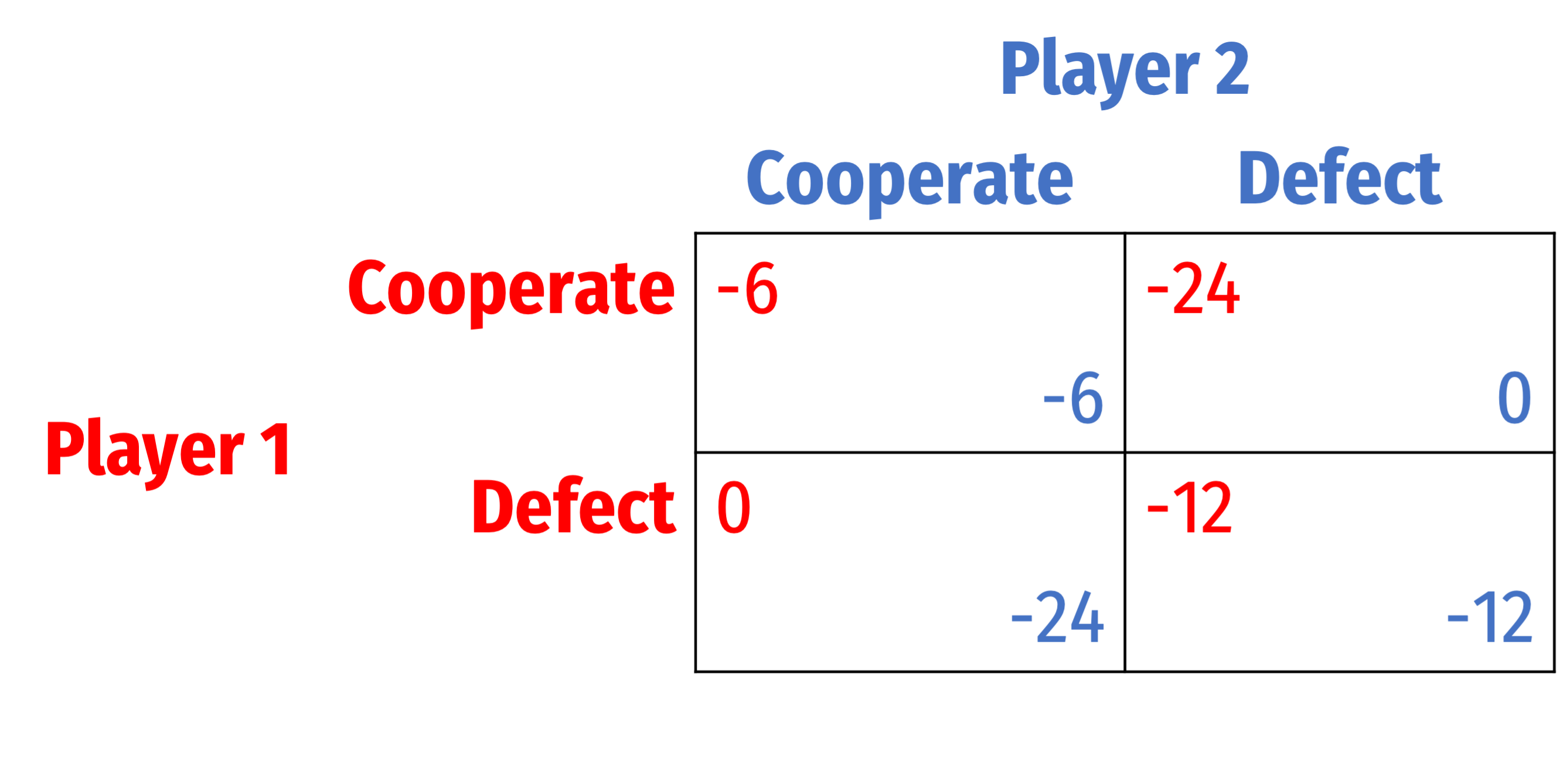

- We will keep the process simple for now by simply assigning numbers to consequences

- In fact, we can assign almost any numbers to the payoffs as long as we keep the order of the payoffs the same

- i.e. so long as u(a)>u(b) for all a≻b

Utility Functions and Payoffs Over Game Outcomes

- We will keep the process simple for now by simply assigning numbers to consequences

- In fact, we can assign almost any numbers to the payoffs as long as we keep the order of the payoffs the same

- i.e. so long as u(a)>u(b) for all a≻b

This is the same game

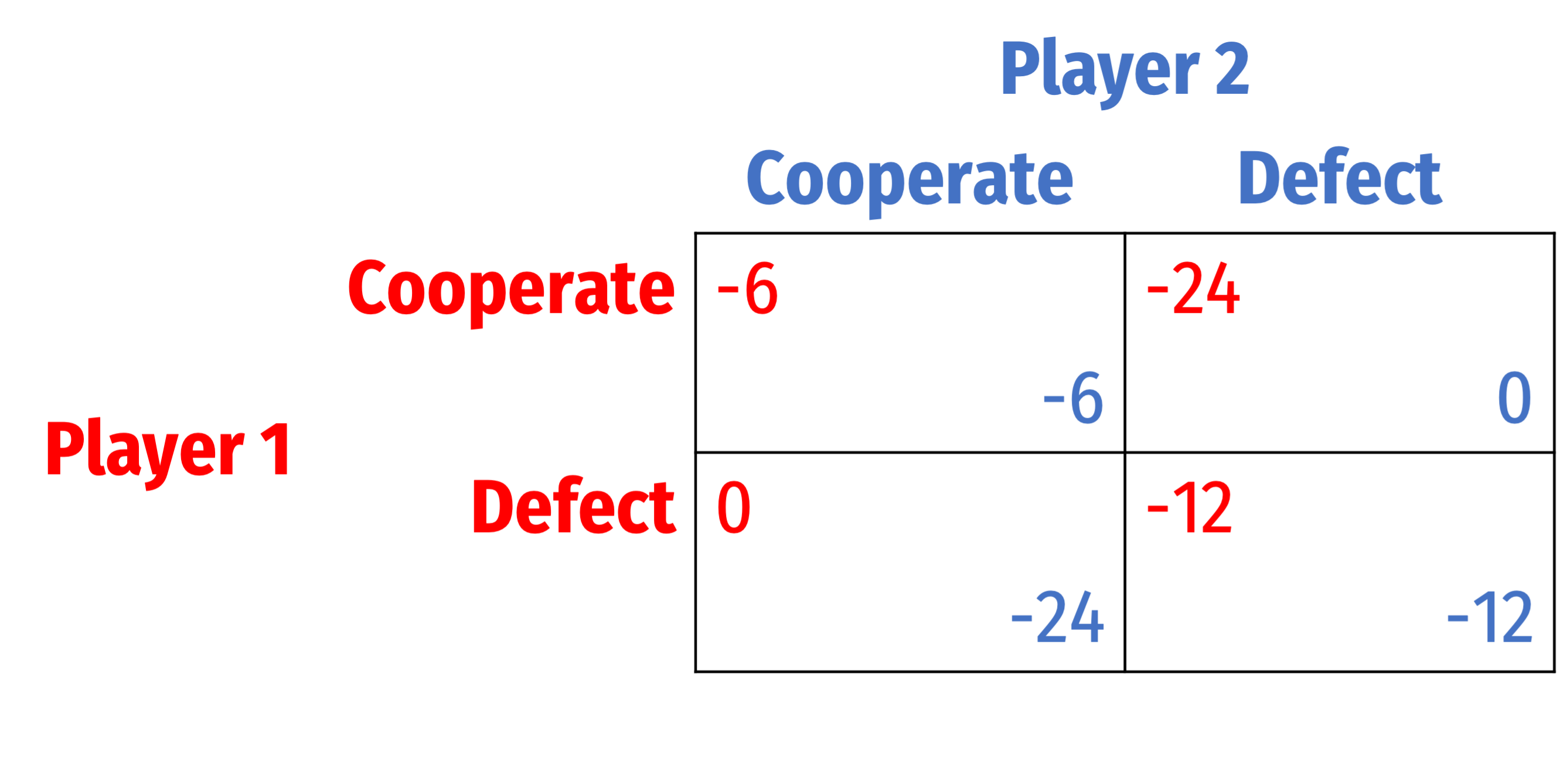

Utility Functions and Payoffs Over Game Outcomes

- We will keep the process simple for now by simply assigning numbers to consequences

- In fact, we can assign almost any numbers to the payoffs as long as we keep the order of the payoffs the same

- i.e. so long as u(a)>u(b) for all a≻b

This is the same game

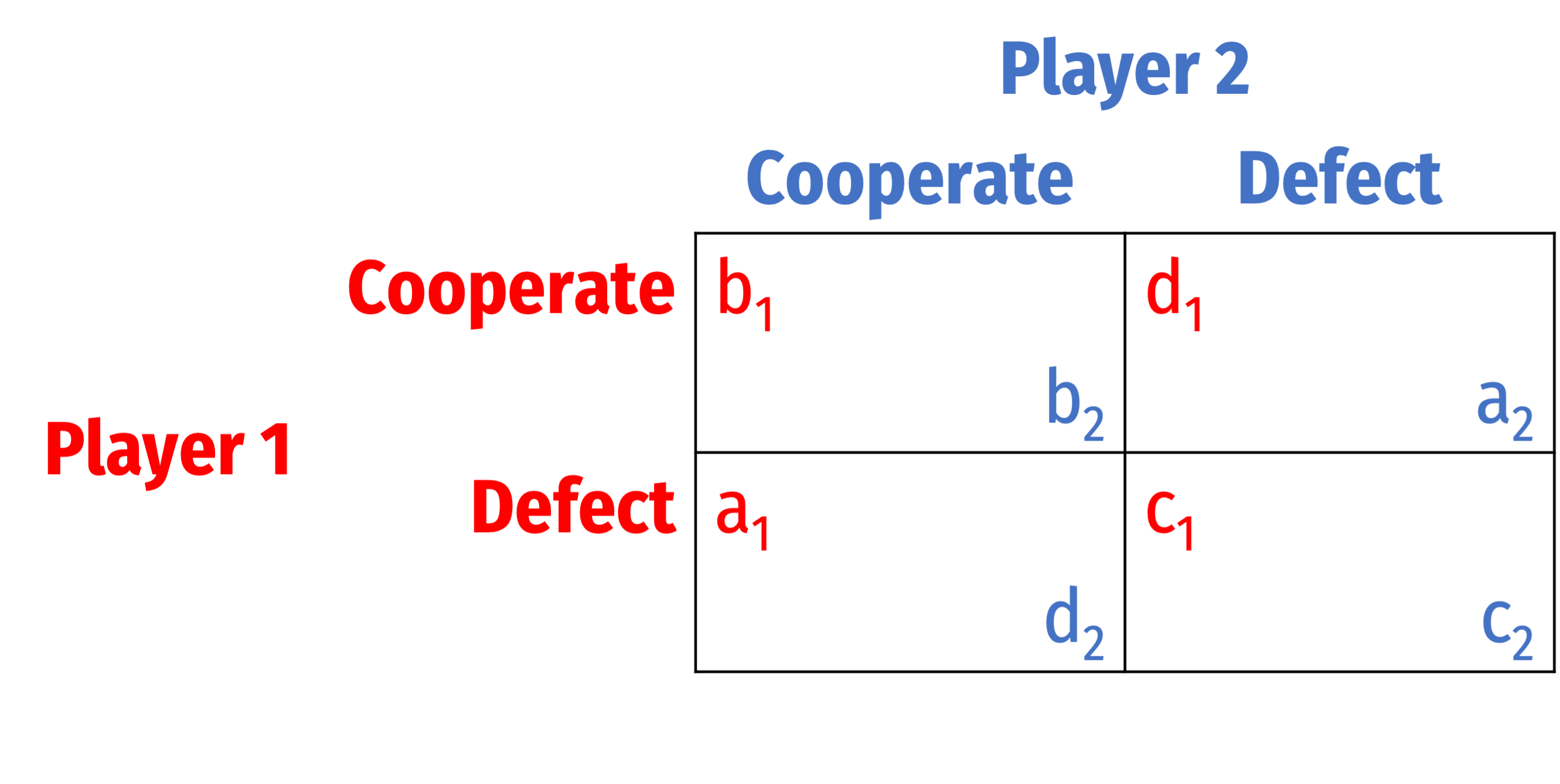

Utility Functions and Payoffs Over Game Outcomes

- We will keep the process simple for now by simply assigning numbers to consequences

- In fact, we can assign almost any numbers to the payoffs as long as we keep the order of the payoffs the same

- i.e. so long as u(a)>u(b) for all a≻b

This is the same game, so long as a>b>c>d

Rationality, Uncertainty, and Risk

We commonly assume, for a game:

Players understand the rules of the game

- Common knowledge assumption

Players behave rationally: try to maximize payoff

- represented usually as (ordinal) utility

- make no mistakes in choosing their strategies

Rationality, Uncertainty, and Risk

Game theory does not permit us to consider true uncertainty

- Must rule out complete surprises (Act of God, etc.)

- What do people maximize in the presence of true uncertainty? Good question

But we can talk about risk: distribution of outcomes occurring with some known probability

In such cases, what do players maximize in the presence of risk?

Rationality, Uncertainty, and Risk

- One hypothesis: players choose strategy that maximizes expected value of payoffs

- probability-weighted average

- leads to a lot of paradoxes!

E[p]=n∑i=1πipi

- π is the probability associated with payoff pi

Rationality, Uncertainty, and Risk

- Refinement by Von Neuman & Morgenstern: players instead maximize expected utility

- utility function over probabilistic outcomes

- still some paradoxes, but fewer!

pa≻pb⟺E[u(pa)]>E[u(pb)]

Allows for different risk attitudes:

- risk neutral, risk-averse, risk-loving

makes utility functions cardinal (but still not measurable!)

- called VNM utility functions

Solution Concepts: Nash Equilibrium

Advancing Game Theory

Von Neumann & Morgenstern (vNM)'s Theory of Games and Economic Behavior (1944) establishes "Game theory"

Solve for outcomes only of 2-player zero-sum games

Minimax method (we'll see below)

Advancing Game Theory

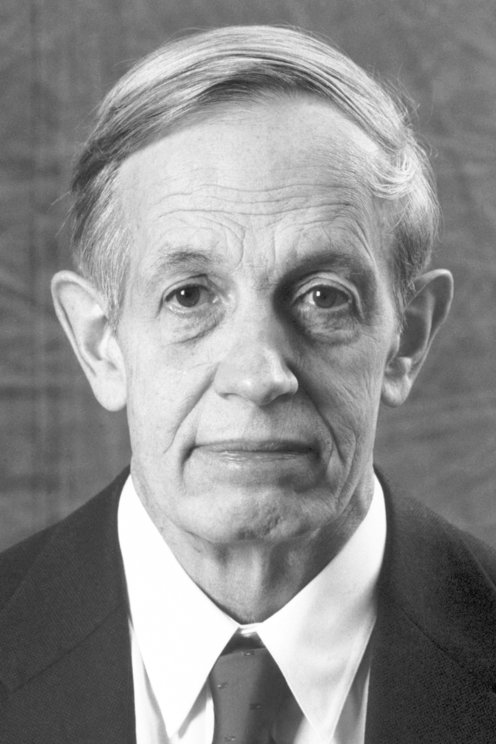

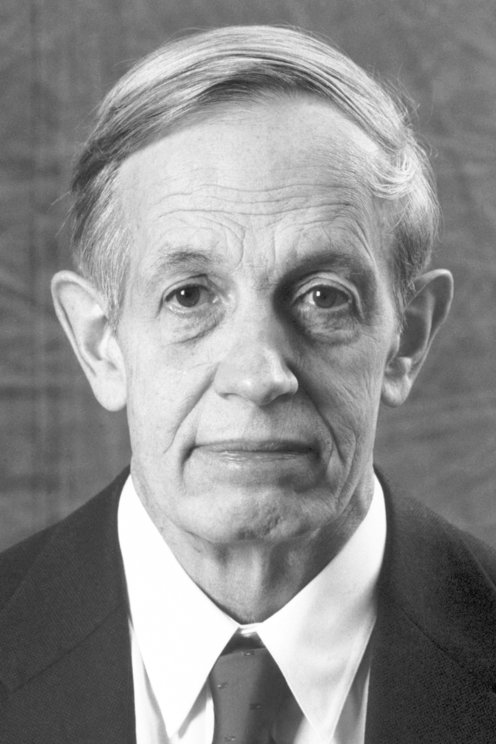

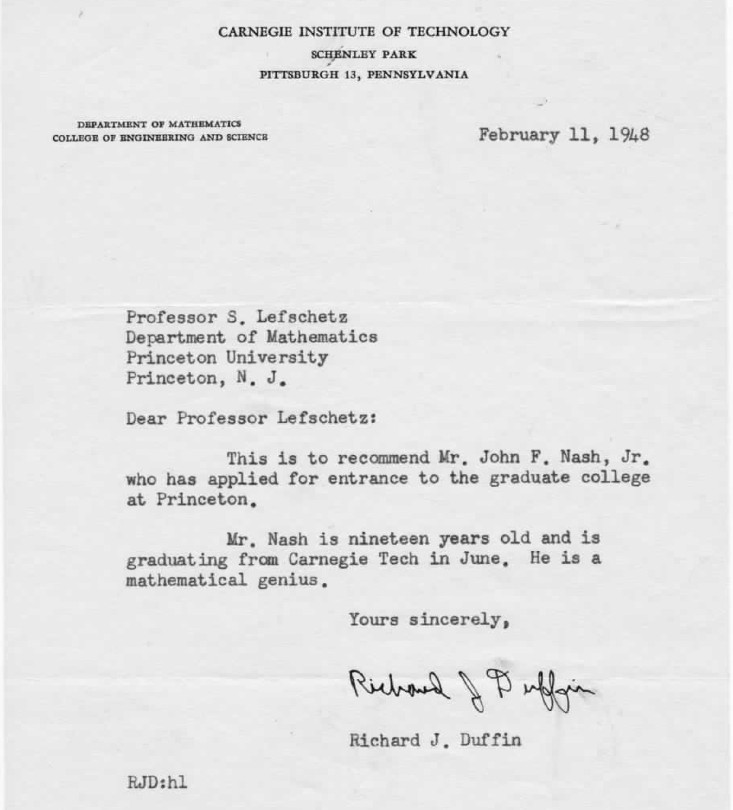

John Forbes Nash

1928—2015

Economics Nobel 1994

Nash's Non-Cooperative Games (1950) dissertation invents idea of "(Nash) Equilibrium"

- Extends for all n-player non-cooperative games (zero sum, negative sum, positive sum)

- Proves an equilibrium exists for all games with finite number of players, strategies, and rounds

Advancing Game Theory

John Forbes Nash

1928—2015

Economics Nobel 1994

A Beautiful Movie, Lousy Economics

A Pure Strategy Nash Equilibrium (PSNE) of a game is a set of strategies (one for each player) such that no player has a profitable deviation from their strategy given the strategies played by all other players

Each player's strategy must be a best response to all other players' strategies

A Beautiful Movie, Lousy Economics

Solution Concepts: Nash Equilibrium

- Recall, Nash Equilibrium: no players want to change their strategy given what everyone else is playing

- All players are playing a best response to each other

Solution Concepts: Nash Equilibrium

- Important about Nash equilibrium:

N.E. ≠ the “best” or optimal outcome

- Recall the Prisoners' Dilemma!

Game may have multiple N.E.

Game may have no N.E. (in “pure” strategies)

All players are not necessarily playing the same strategy

Each player makes the same choice each time the game is played (possibility of mixed strategies)

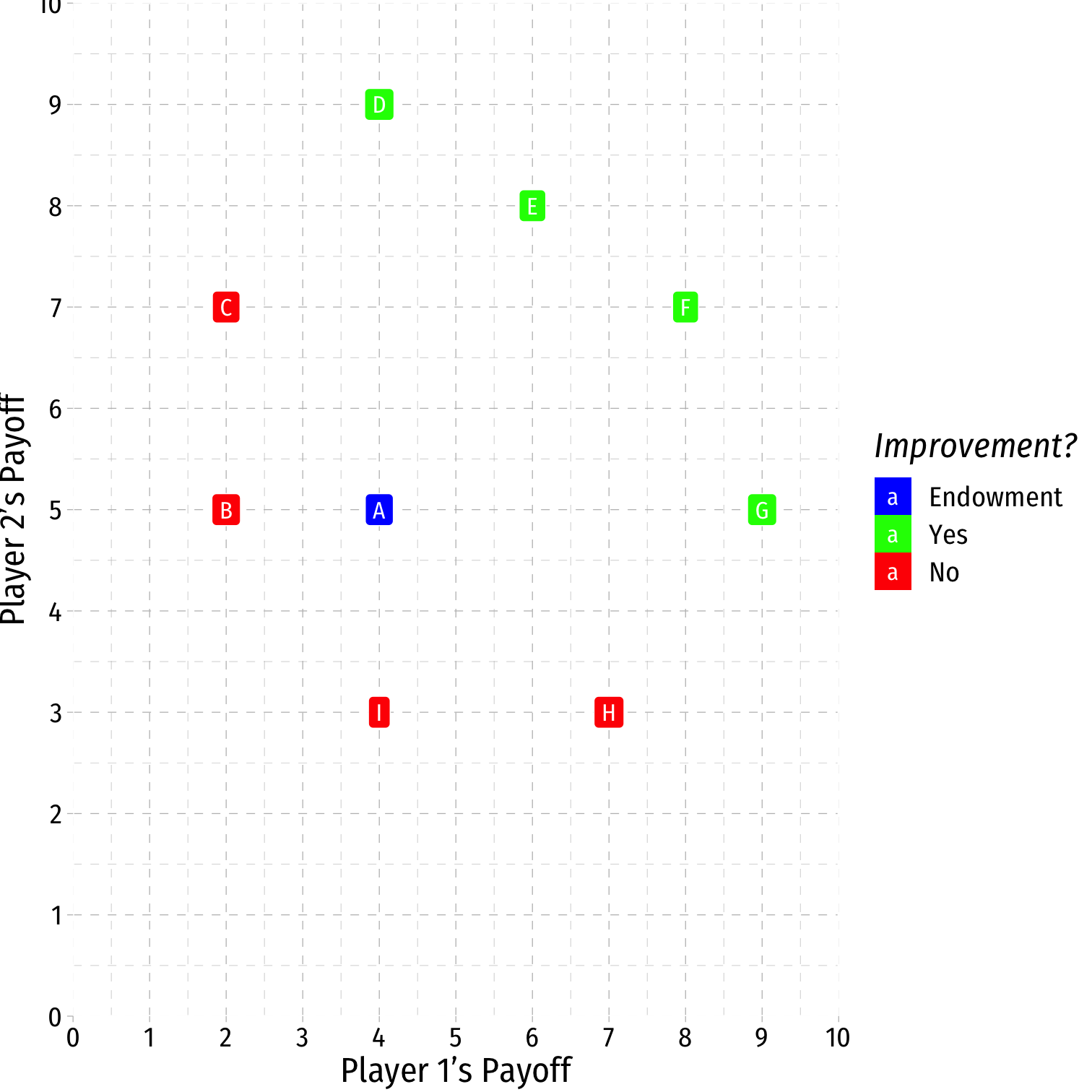

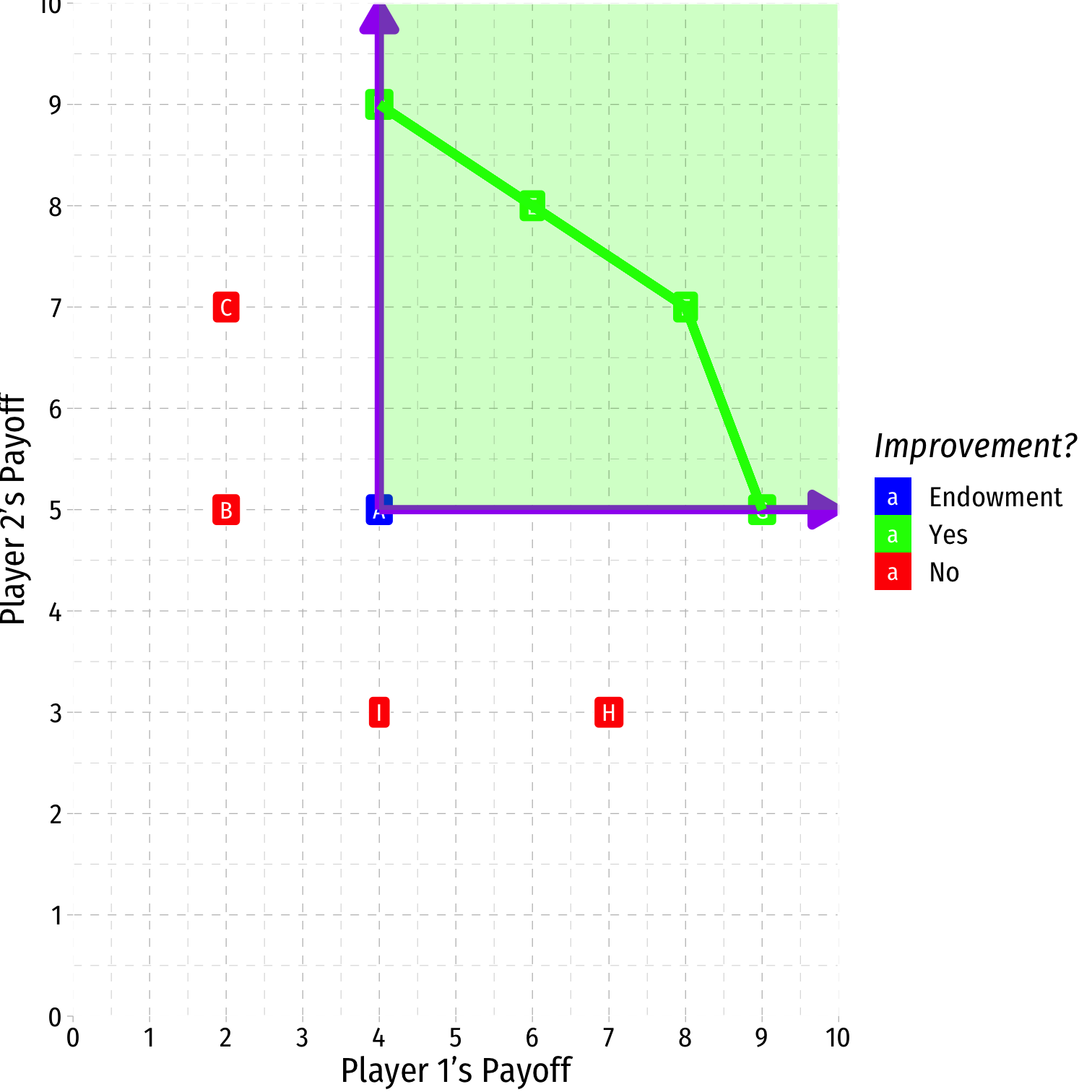

Pareto Efficiency

- Suppose we start from some initial allocation (A)

Pareto Efficiency

Suppose we start from some initial allocation (A)

Pareto Improvement: at least one party is better off, and no party is worse off

- D, E, F, G are improvements

- B, C, H, I are not

Pareto Efficiency

Suppose we start from some initial allocation (A)

Pareto Improvement: at least one party is better off, and no party is worse off

- D, E, F, G are improvements

- B, C, H, I are not

Pareto optimal/efficient: no possible Pareto improvements

- Set of Pareto efficient points often called the Pareto frontier†

- Many possible efficient points!

†I’m simplifying...for full details, see class 1.8 appendix about applying consumer theory!

Pareto Efficiency and Games

Take the prisoners’ dilemma

Nash Equilibrium: (Defect, Defect)

- neither player has an incentive to change strategy, given the other's strategy

Why can’t they both cooperate?

- A clear Pareto improvement!

Pareto Efficiency and Games

Main feature of prisoners’ dilemma: the Nash equilibrium is Pareto inferior to another outcome (Cooperate, Cooperate)!

- But that outcome is not a Nash equilibrium!

- Dominant strategies to Defect

How can we ever get rational cooperation?

Nash Equilibrium and Solution Concepts

This is far from the last word on solution concepts, or even Nash equilibrium!

But sufficient for now, until we return to simultaneous games

Next week, sequential games!