2.4 — Stackelberg Competition

ECON 316 • Game Theory • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/gameF21

gameF21.classes.ryansafner.com

Models of Oligopoly

Three canonical models of Oligopoly

- Bertrand competition

- Firms simultaneously compete on price

- Cournot competition

- Firms simultaneously compete on quantity

- Stackelberg competition

- Firms sequentially compete on quantity

Stackelberg Competition

Henrich von Stackelberg

1905-1946

"Stackelberg competition": Cournot-style competition, two (or more) firms compete on quantity to sell the same good

Again, firms' joint output determines the market price faced by all firms

But firms set their quantities sequentially

- Leader produces first

- Follower produces second

Stackelberg Competition: Example

Example: Return to Saudi Arabia (sa) and Iran (i), again with the market (inverse) demand curve: P=200−3QQ=qsa+qi

Stackelberg Competition: Example

Example: Return to Saudi Arabia (sa) and Iran (i), again with the market (inverse) demand curve: P=200−3QQ=qsa+qi

- We solved for Saudi Arabia and Iran's reaction functions in Cournot competition last class:

q∗sa=30−0.5qiq∗i=30−0.5qsa

Stackelberg Competition: Example

q∗sa=30−0.5qiq∗i=30−0.5qsa

- Suppose Saudi Arabia is the Stackelberg leader and produces qsa first

Stackelberg Competition: Example

q∗sa=30−0.5qiq∗i=30−0.5qsa

- Suppose Saudi Arabia is the Stackelberg leader and produces qsa first

- Saudi Arabia knows exactly how Iran will respond to its output

q∗i=30−0.5qsa

Stackelberg Competition: Example

q∗sa=30−0.5qiq∗i=30−0.5qsa

- Suppose Saudi Arabia is the Stackelberg leader and produces qsa first

- Saudi Arabia knows exactly how Iran will respond to its output

q∗i=30−0.5qsa

- Saudi Arabia, as leader, essentially faces entire market demand

- But can't act like a pure monopolist!

- knows that follower will still produce afterwards, which pushes down market price for both firms!

Stackelberg Competition: Example

- Substitute follower's reaction function into (inverse) market demand function faced by leader

Stackelberg Competition: Example

- Substitute follower's reaction function into (inverse) market demand function faced by leader

P=200−3qsa−3(30−0.5qsa)P=110−1.5qsa

Stackelberg Competition: Example

- Substitute follower's reaction function into (inverse) market demand function faced by leader

P=200−3qsa−3(30−0.5qsa)P=110−1.5qsa

- Now find MR(q) for Saudi Arabia from this by doubling the slope:

Stackelberg Competition: Example

- Substitute follower's reaction function into (inverse) market demand function faced by leader

P=200−3qsa−3(30−0.5qsa)P=110−1.5qsa

- Now find MR(q) for Saudi Arabia from this by doubling the slope:

MRLeader=110−3qsa

Stackelberg Competition: Example

- Now Saudi Arabia can find its optimal quantity:

MRLeader=MC110−3qsa=2030=q∗sa

Stackelberg Competition: Example

- Now Saudi Arabia can find its optimal quantity:

MRLeader=MC110−3qsa=2030=q∗sa

- Iran will optimally respond by producing:

q∗i=30−0.5qsaq∗i=30−0.5(30)q∗i=15

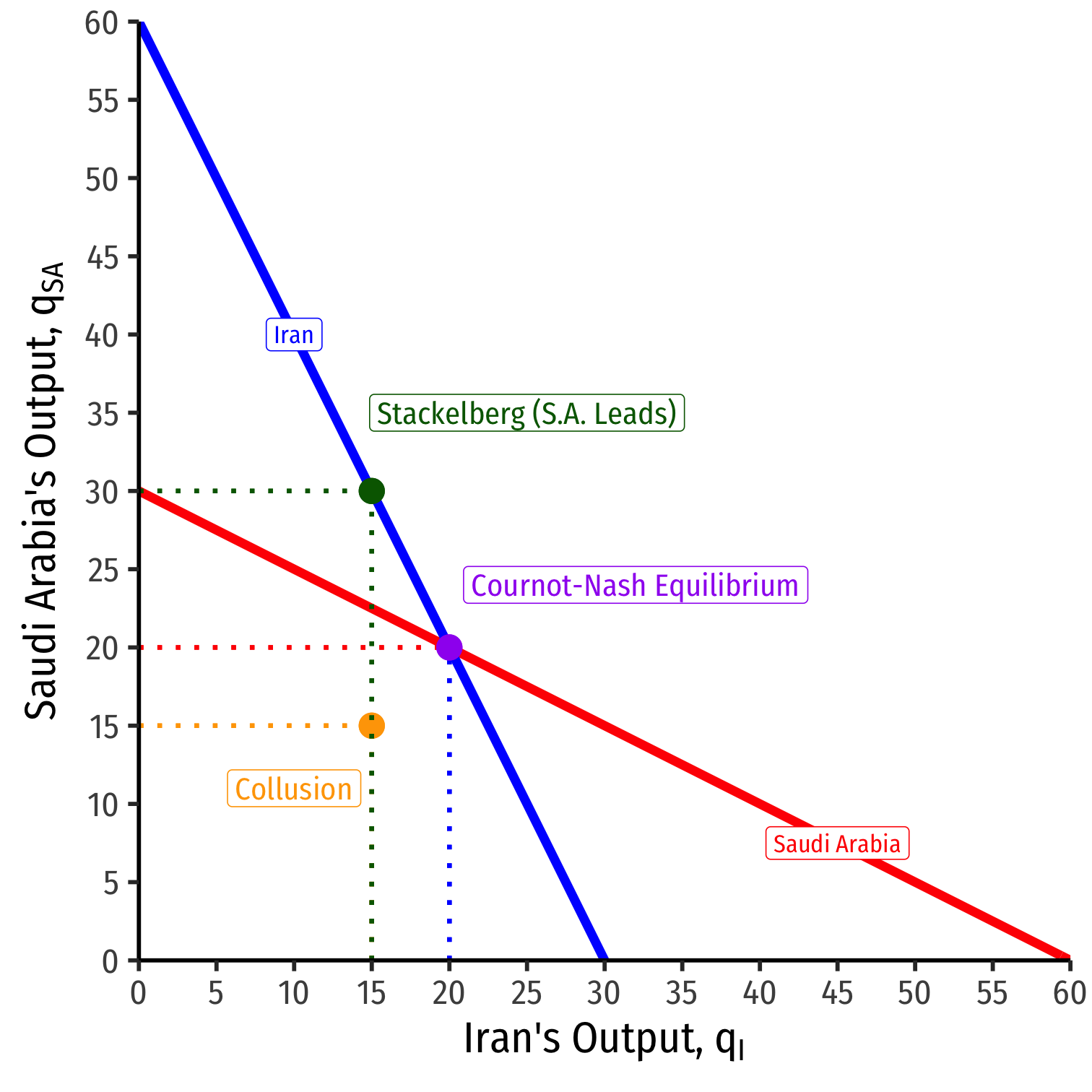

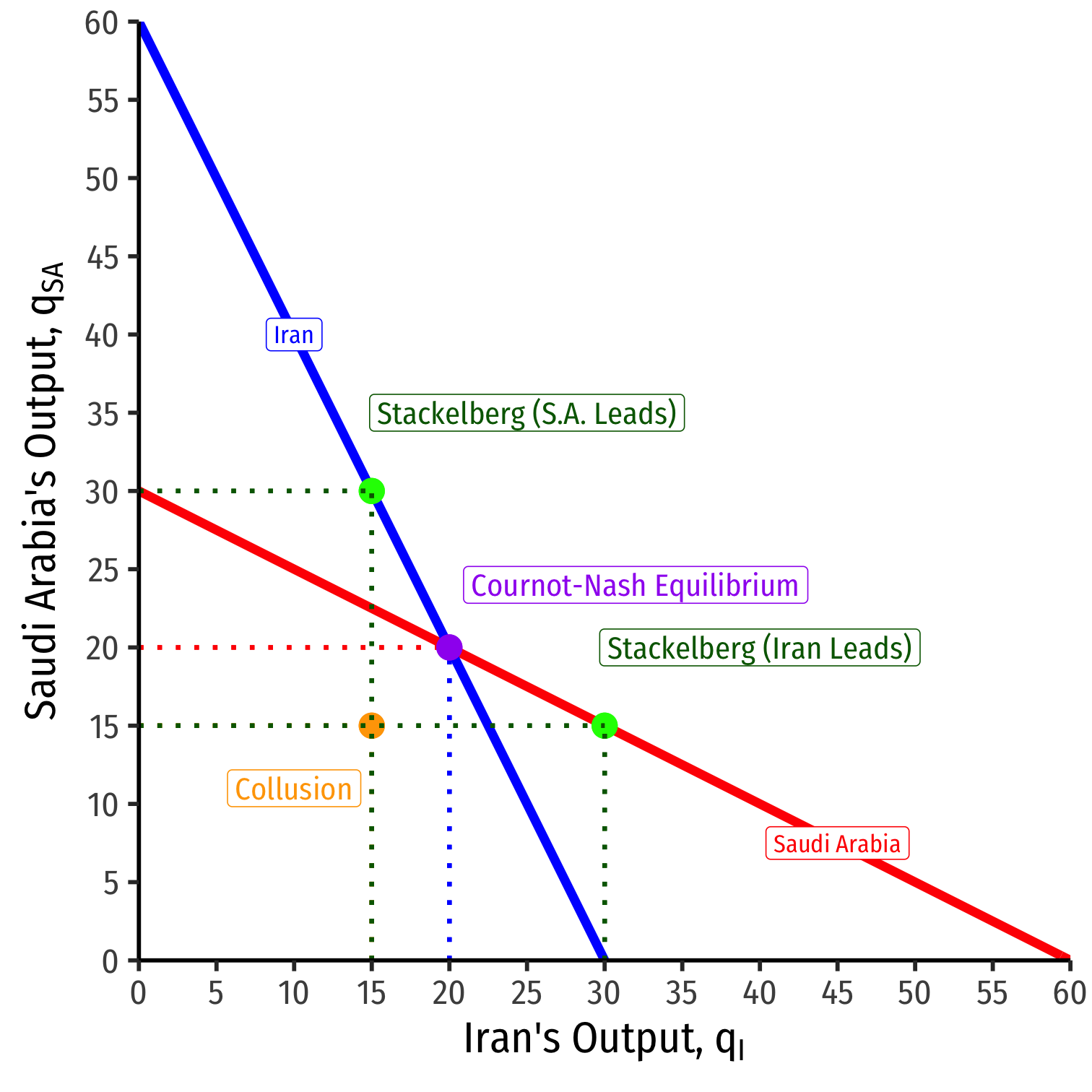

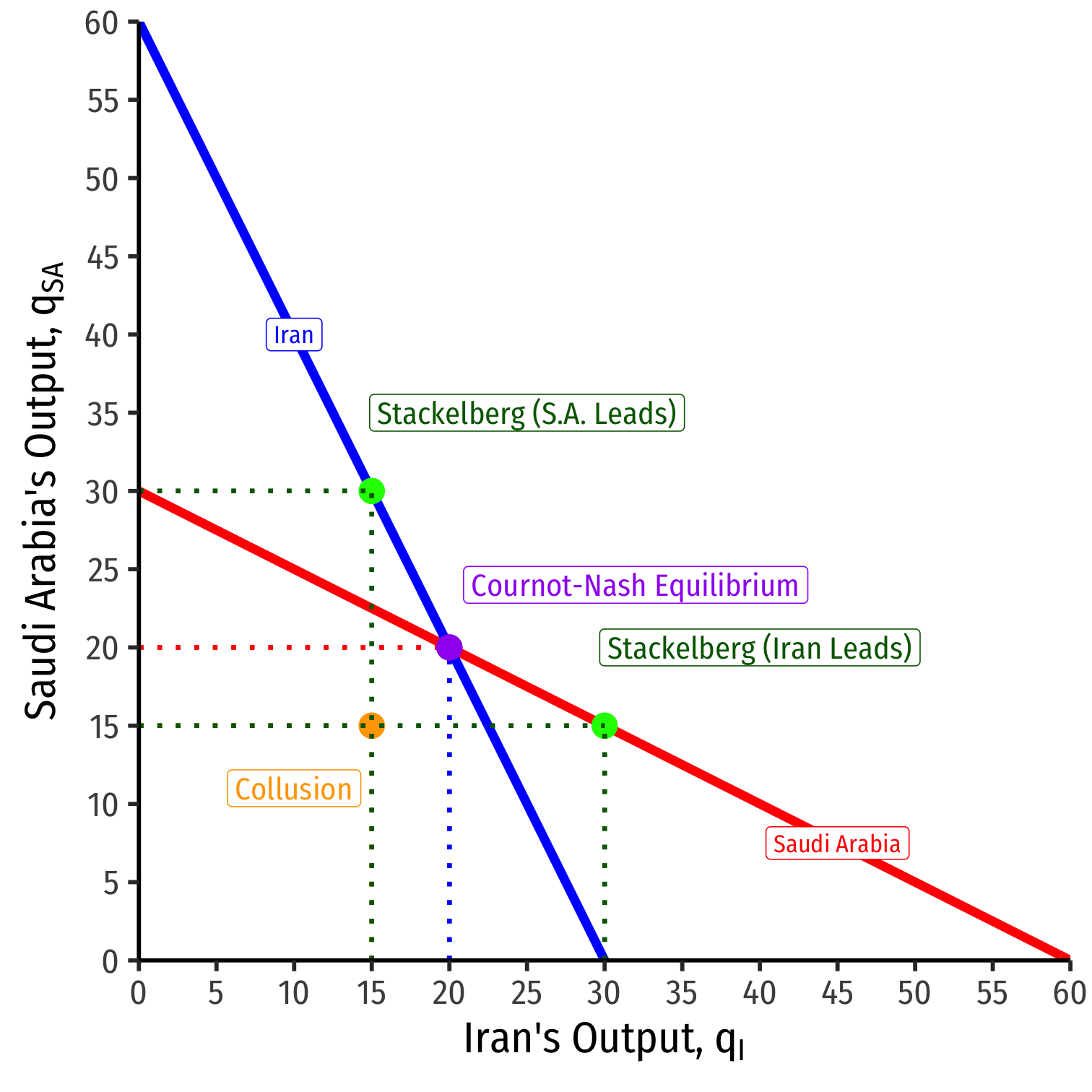

Stackelberg Equilibrium, Graphically

- Stackelberg Nash Equilibrium: (q∗sa=30,q∗i=15)

Stackelberg Competition: Example

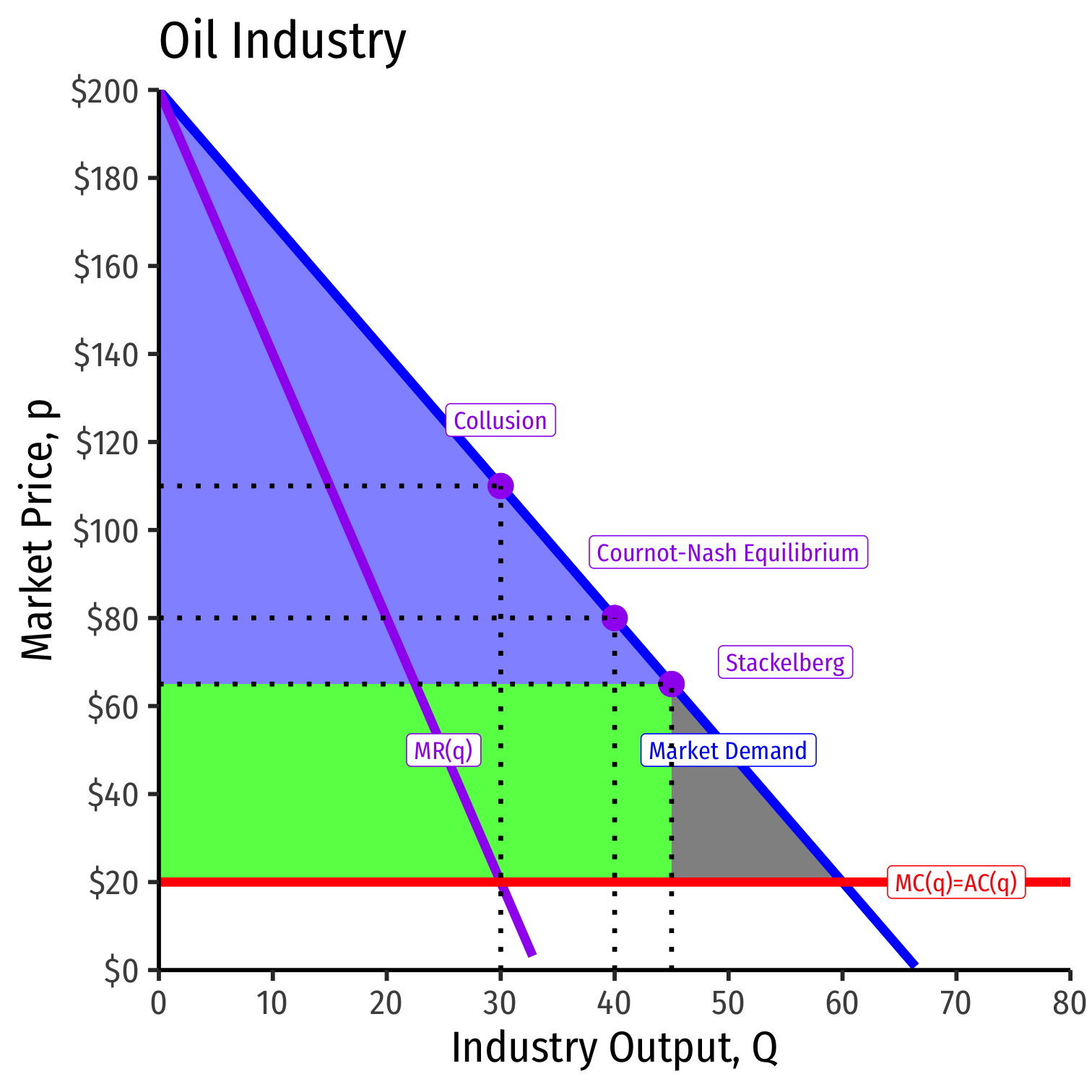

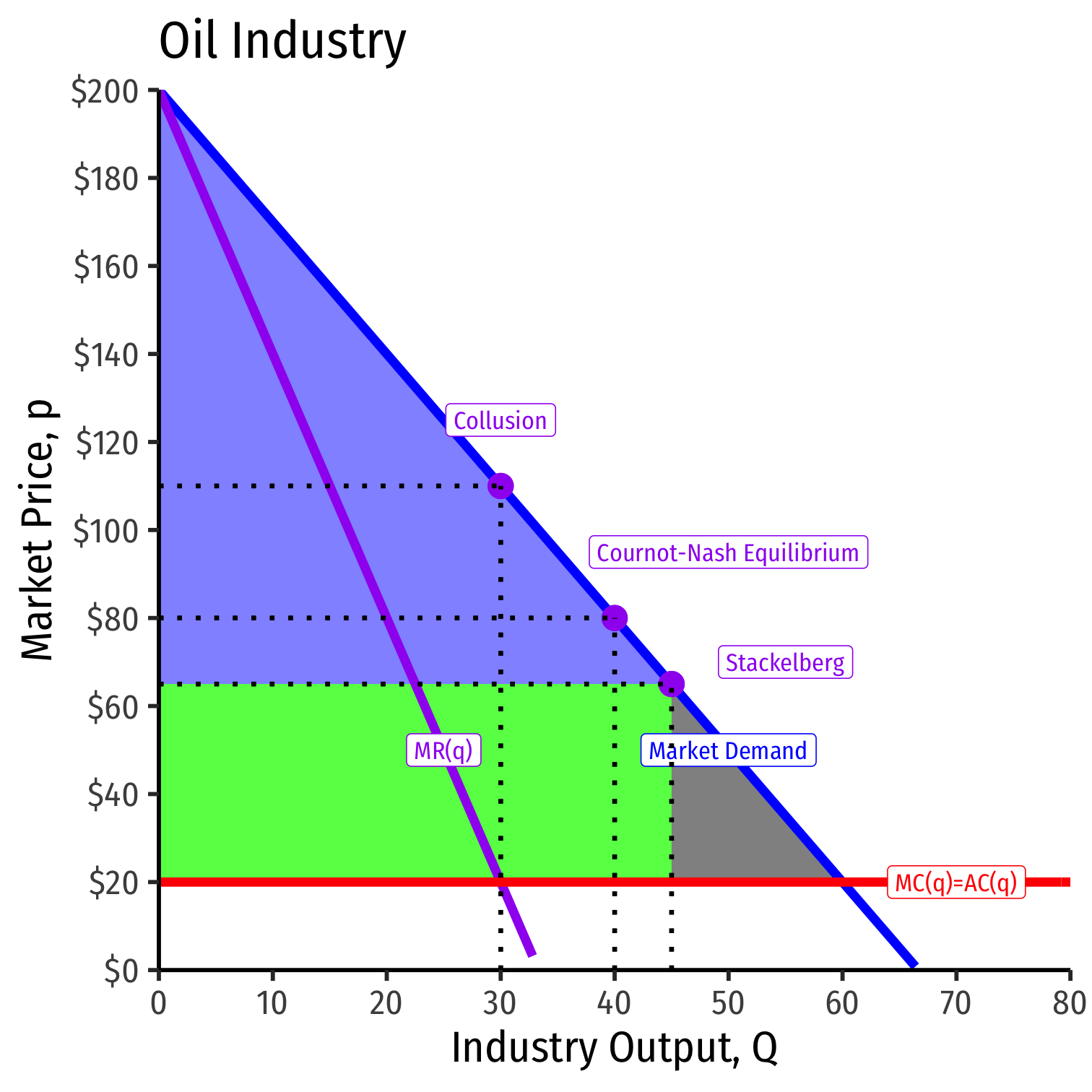

- With q∗sa=30 and q∗i=15, this sets a market-clearing price of:

P=200−3(45)P=65

Stackelberg Competition: Example

- With q∗sa=30 and q∗i=15, this sets a market-clearing price of:

P=200−3(45)P=65

- Saudi Arabia's profit would be:

πsa=30(65−20)πsa=$1,350

Stackelberg Competition: Example

- With q∗sa=30 and q∗i=15, this sets a market-clearing price of:

P=200−3(45)P=65

- Saudi Arabia's profit would be:

πsa=30(65−20)πsa=$1,350

- Iran's profit would be:

πi=15(65−20)πi=$675

Stackelberg Equilibrium, The Market

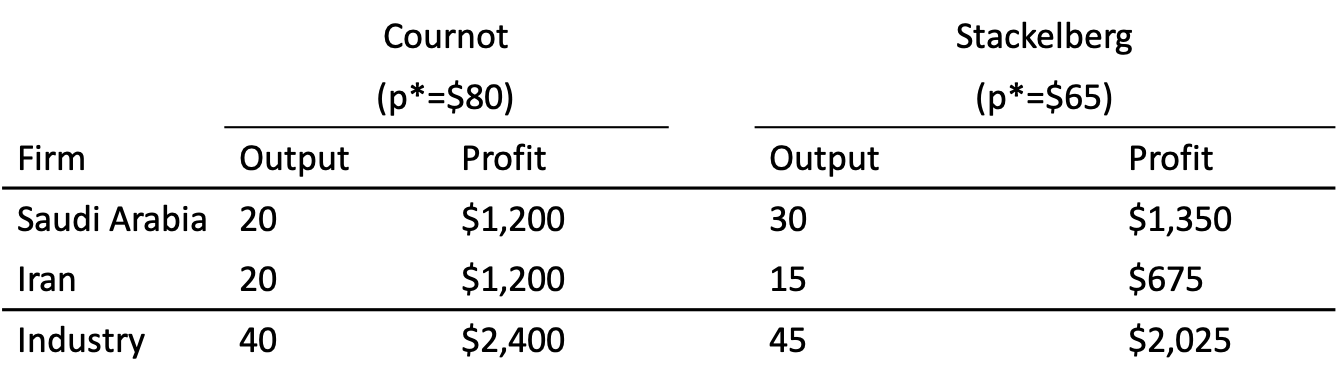

Cournot vs. Stackelberg Competition

Leader Saudi Arabia ↑ its output and ↑ profits

Follower Iran forced to ↓ its output and accept ↓ profits

Stackelberg and First-Mover Advantage

Stackelberg leader clearly has a first-mover advantage over the follower

- Leader: q∗=30, π=1,350

- Follower: q∗=15, π=675

If firms compete simultaneously (Cournot): q∗=20, π=1,200 each

Leading ≻ simultaneous ≻ Following

Stackelberg and First-Mover Advantage

Stackelberg Nash equilibrium requires perfect information for both leader and follower

- Follower must be able to observe leader's output to choose its own

- Leader must believe follower will see leader's output and react optimally

Imperfect information reduces the game to (simultaneous) Cournot competition

Stackelberg and First-Mover Advantage

Again, leader cannot act like a monopolist

- A strategic game! Market output (that pushes down market price) is Q=qsa+qi

Leader's choice of 30 is optimal only if follower responds with 15

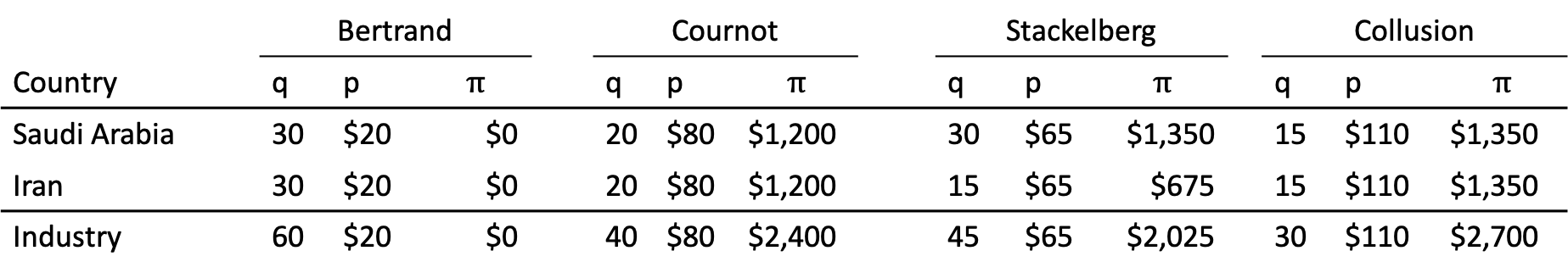

Comparing All Oligopoly Models

- Output: Qm<Qc<Qs<Qb

- Market price: Pb<Ps<Pc<Pm

- Profit: πb=0<πs<πc<πm

Where subscript m is monopoly (collusion), c is Cournot, s is Stackelberg, b is Bertrand

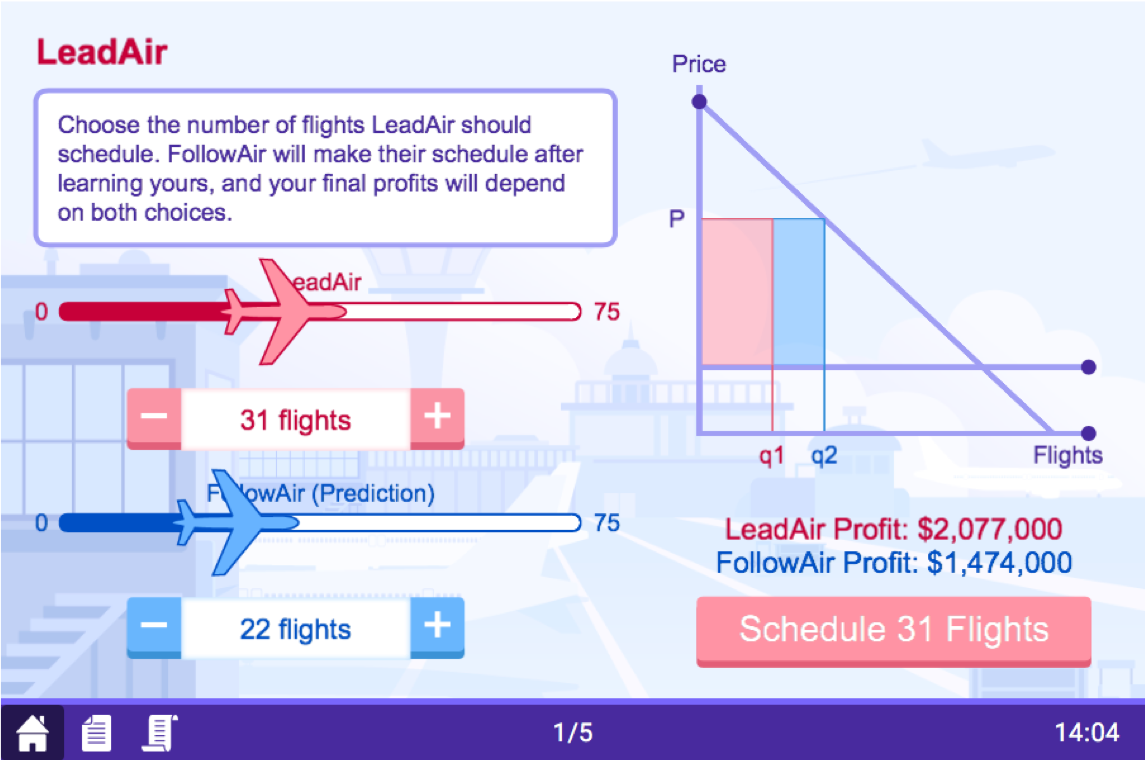

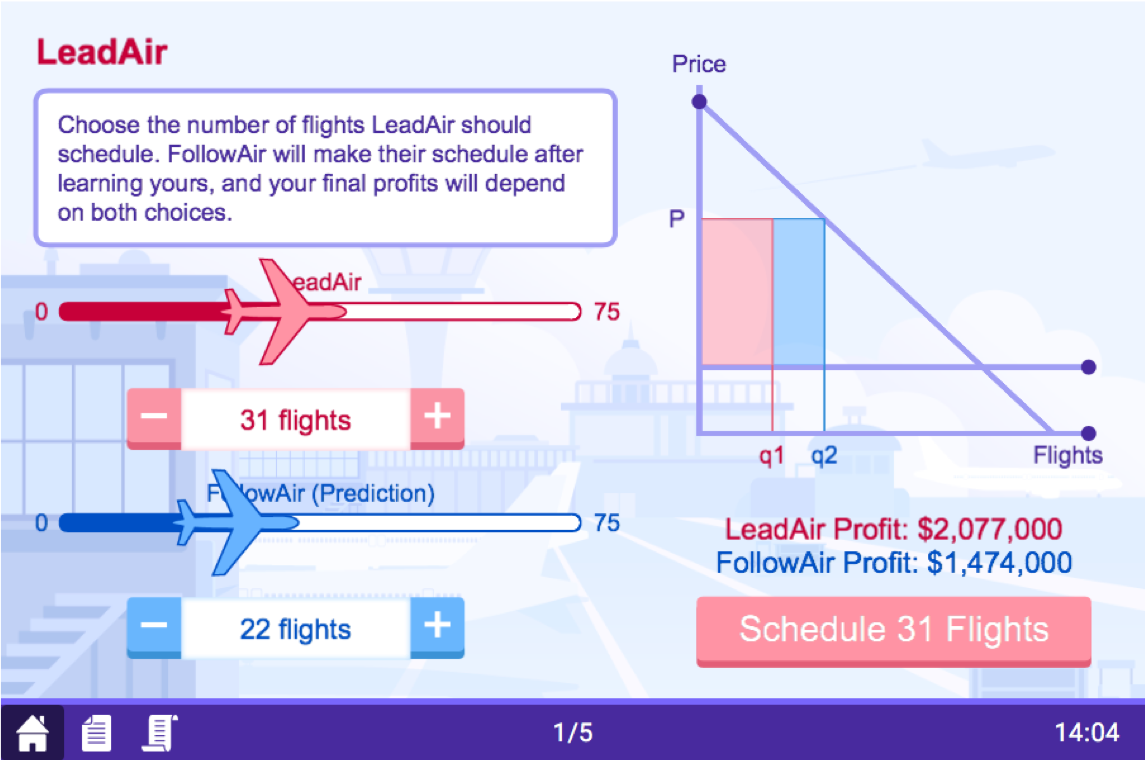

Stackelberg Competition: Moblab

Stackelberg Competition: Moblab

Each of you is one Airline competing against another in a duopoly

- Each pays same per-flight cost

- Market price determined by total number of flights in market

LeadAir first chooses its number of flights, publicly announced

FollowAir then chooses its number of flights