3.2 — Repeated Games

ECON 316 • Game Theory • Fall 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/gameF21

gameF21.classes.ryansafner.com

Prisoners' Dilemma, Reprise

Prisoners' Dilemma, Reprise

Prisoners' Dilemma, Reprise

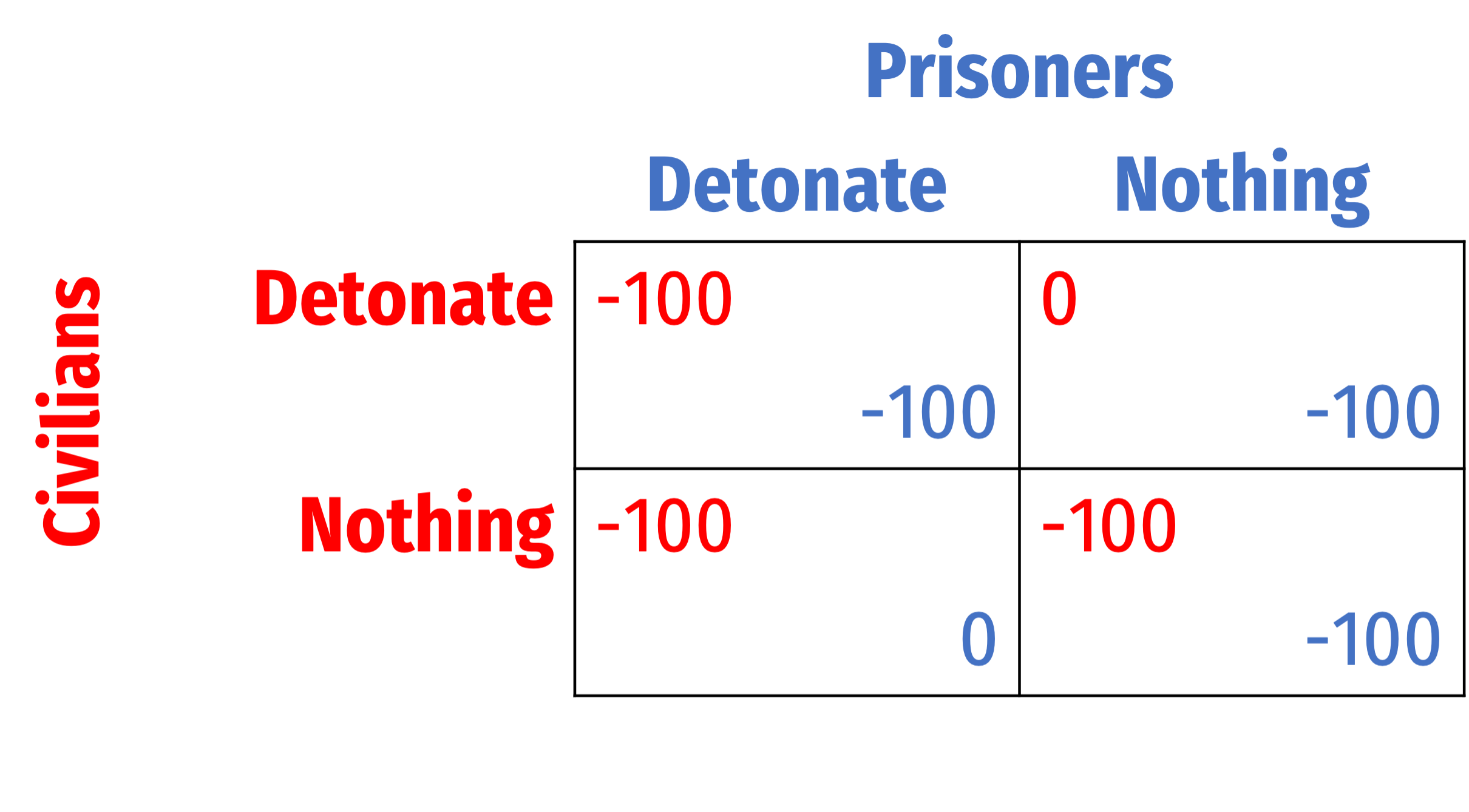

Not technically a Prisoners' Dilemma!

- Game affected by Joker's threat to blow both of them up at midnight if nobody acts

Both players have a weakly-dominant strategy to Detonate

What is/are the Nash equilibrium/equilibria?

Prisoners' Dilemma, Reprise

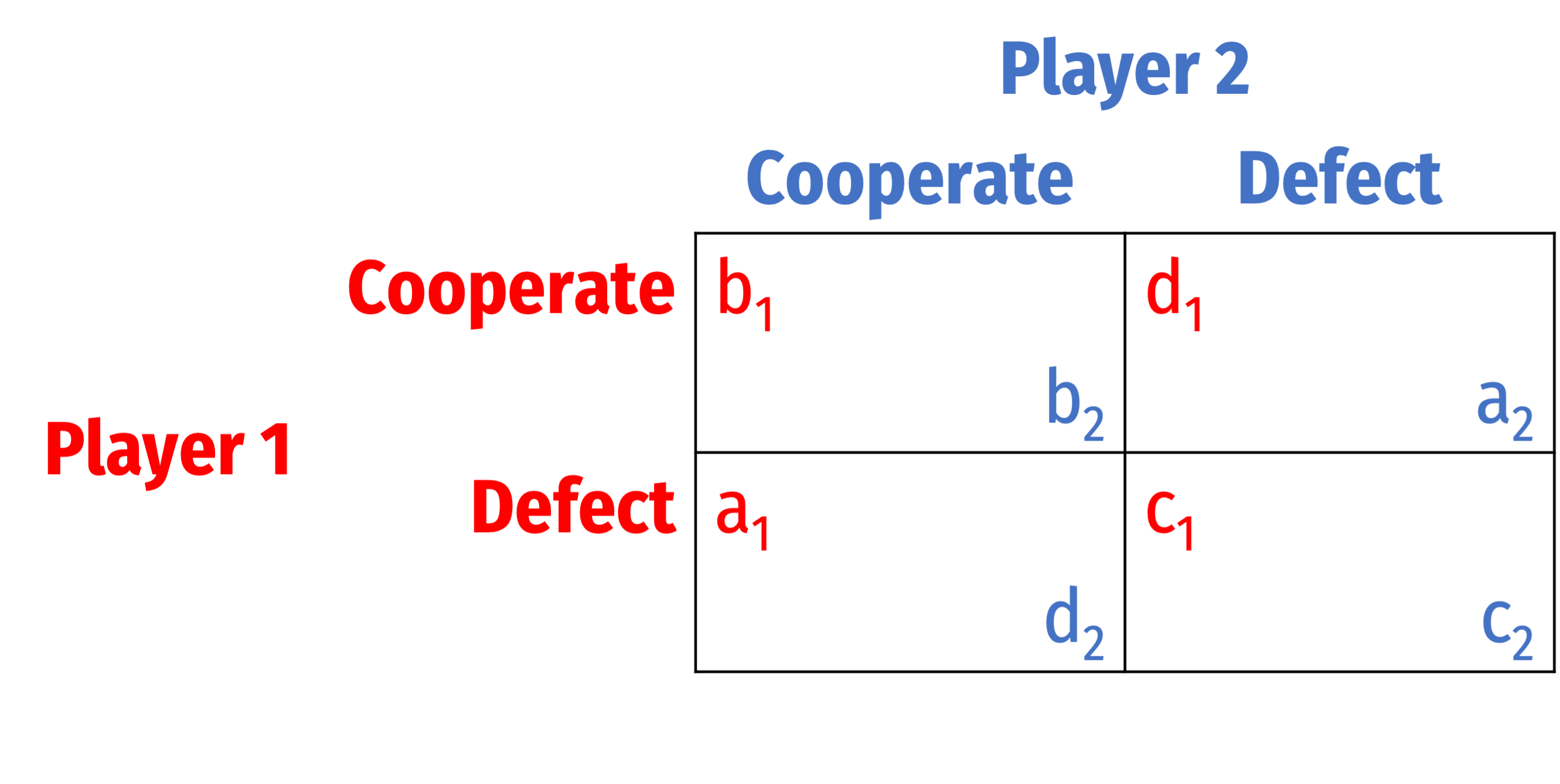

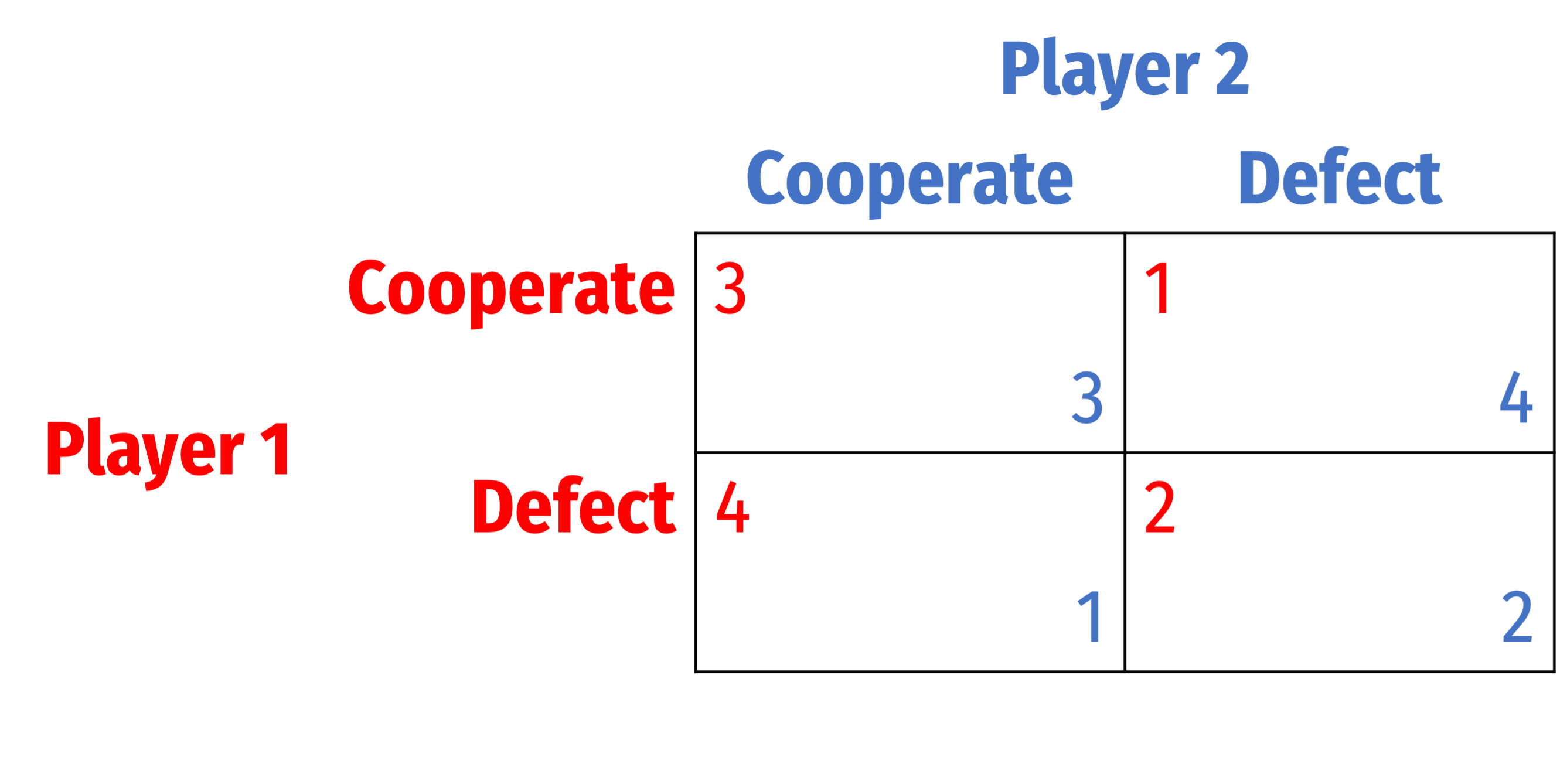

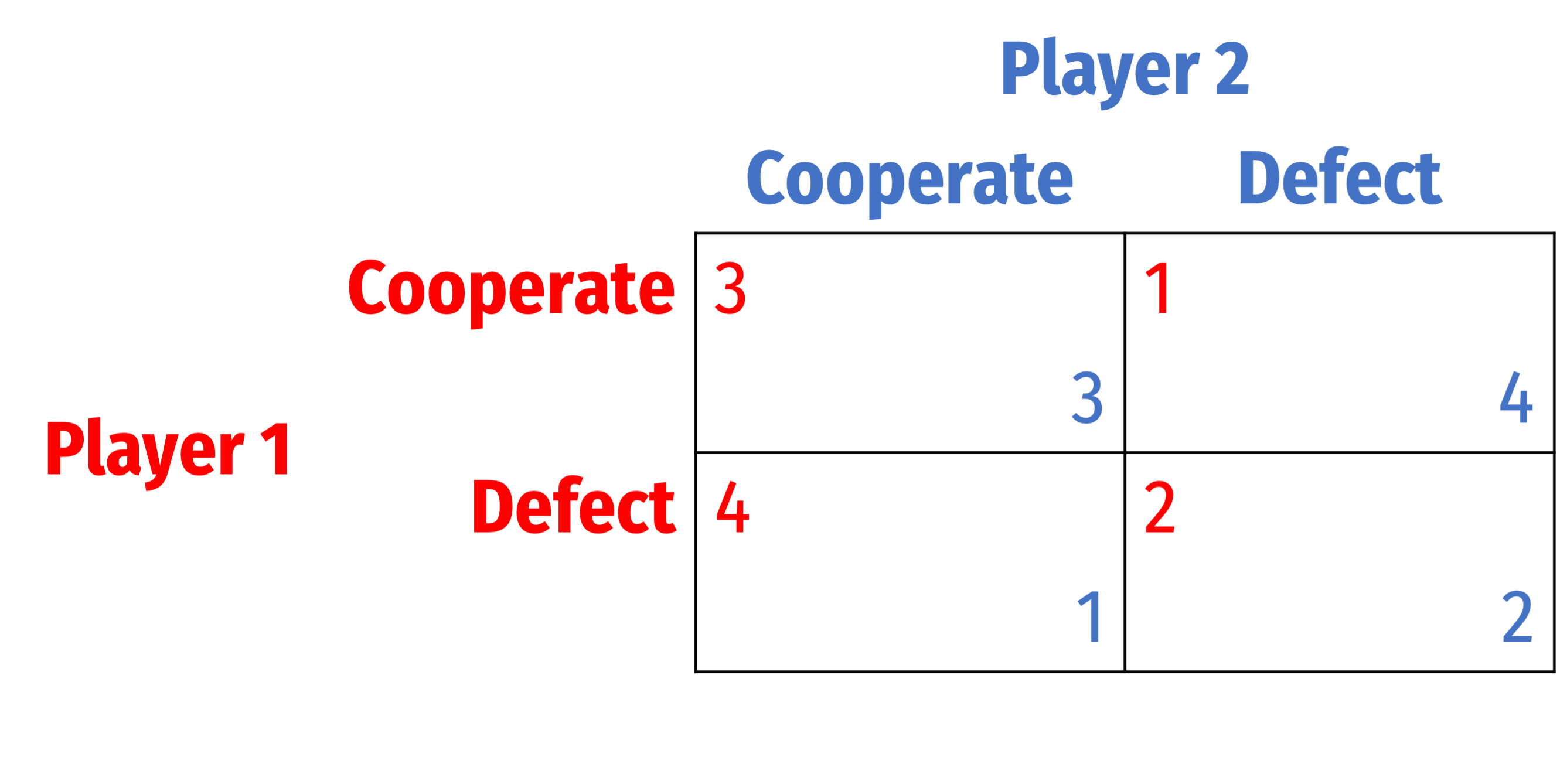

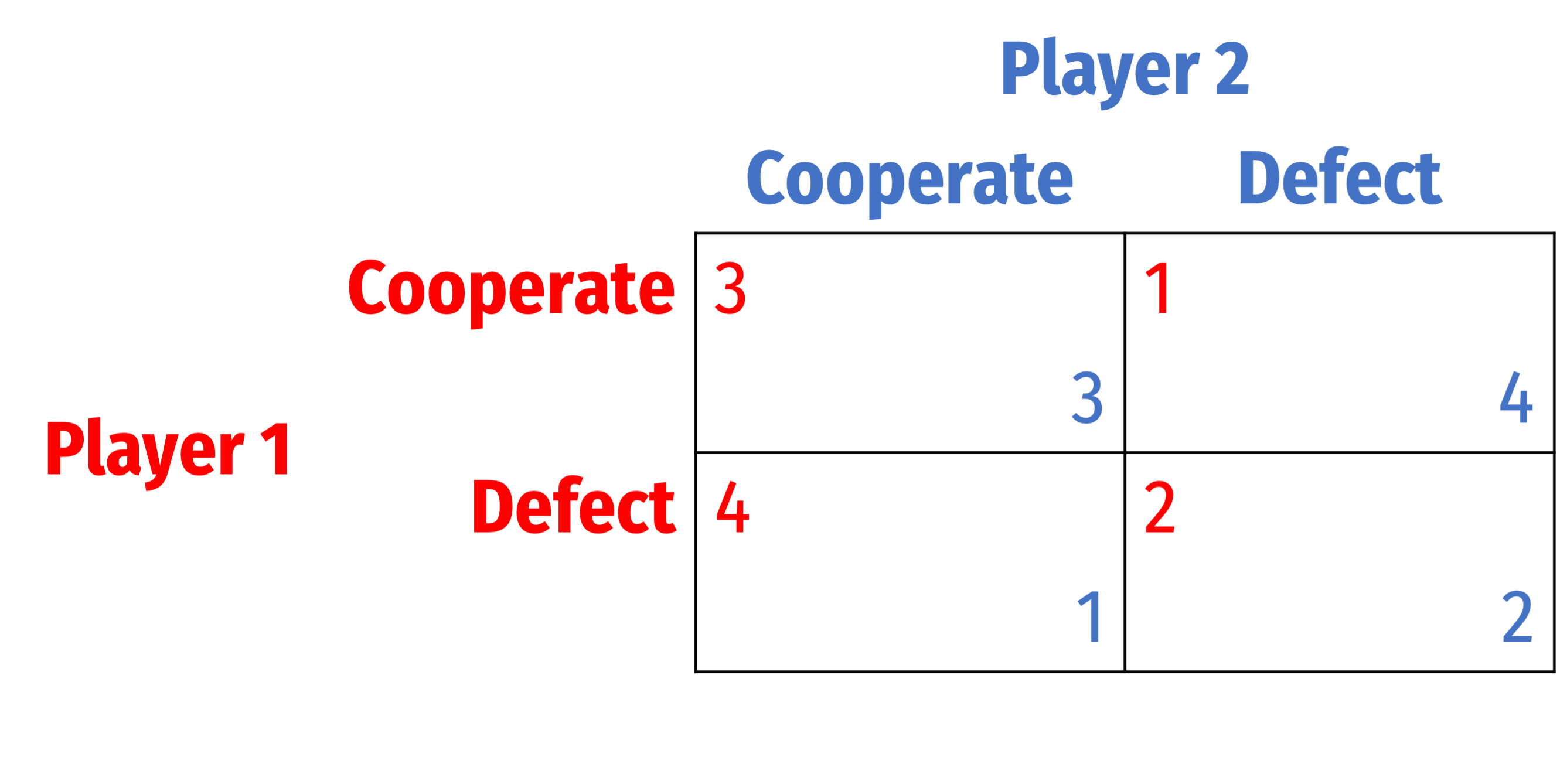

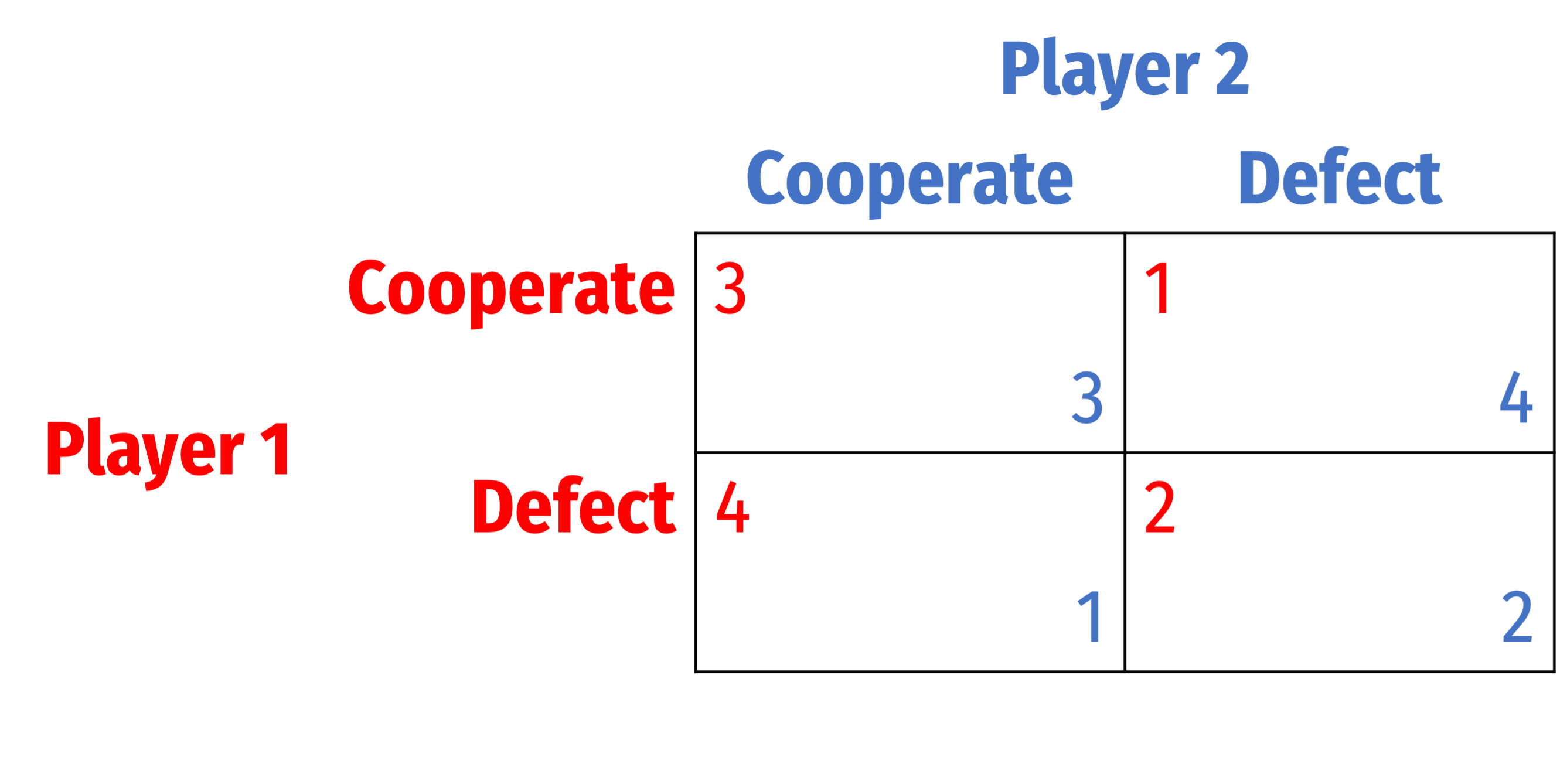

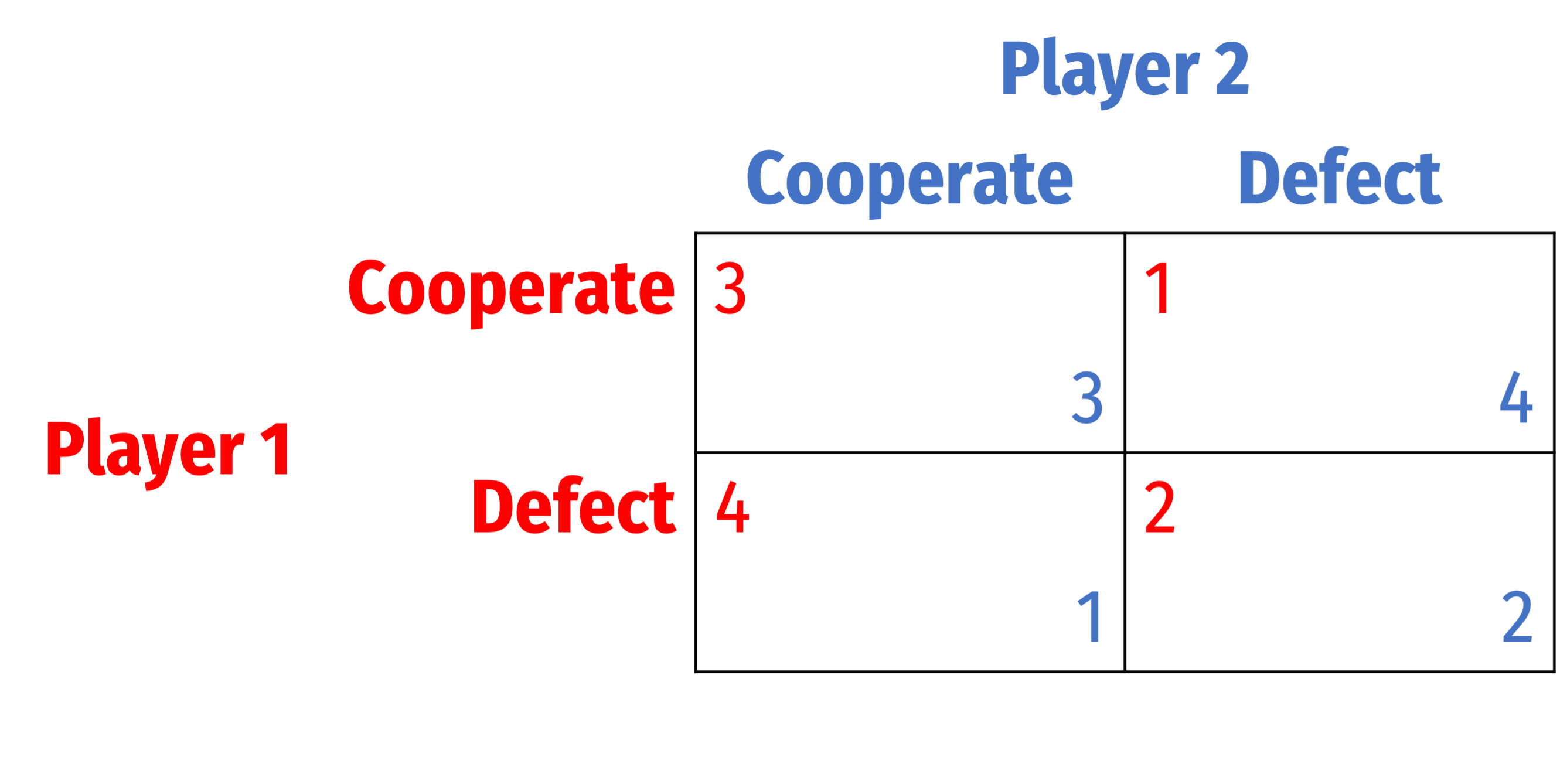

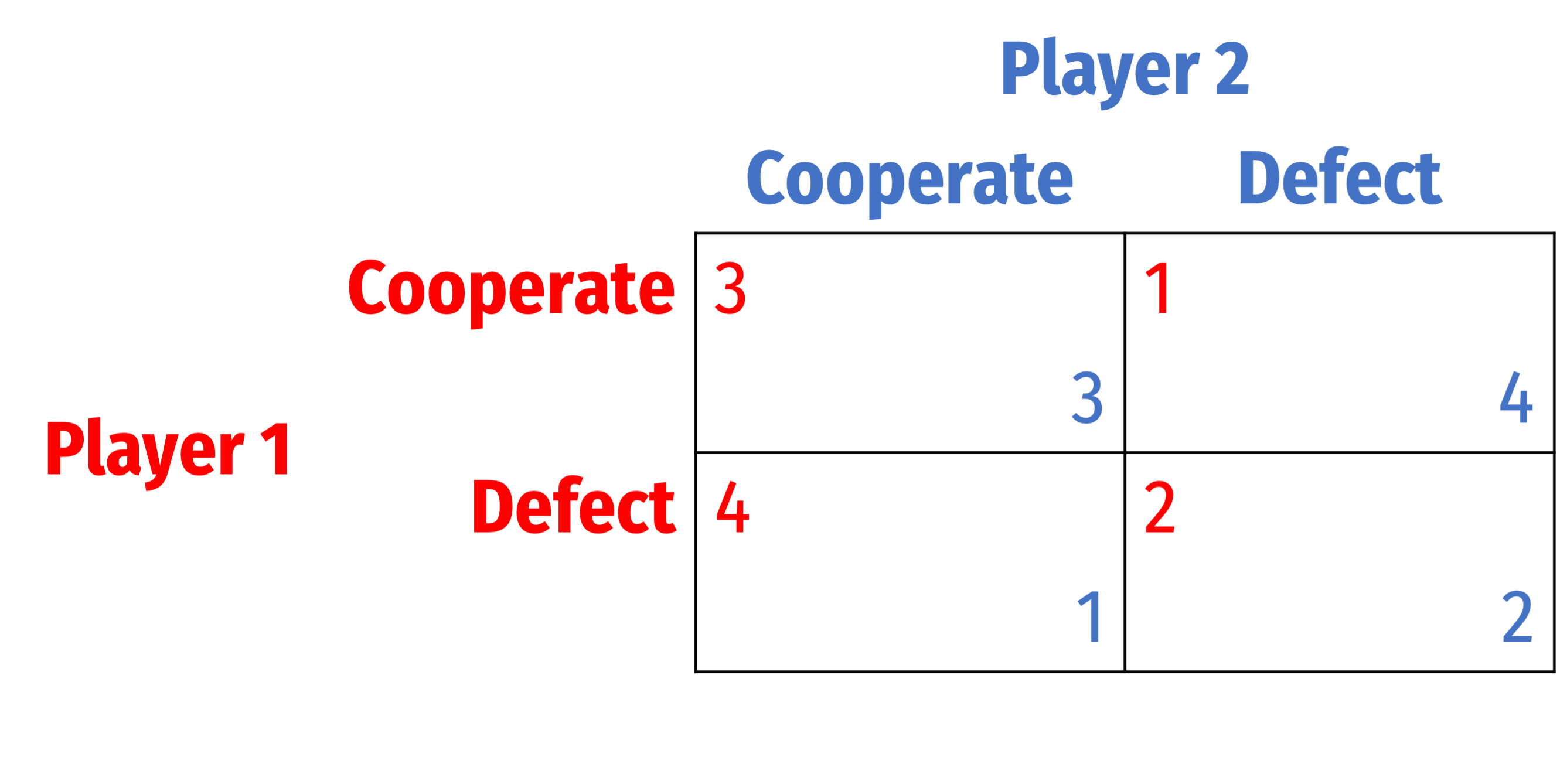

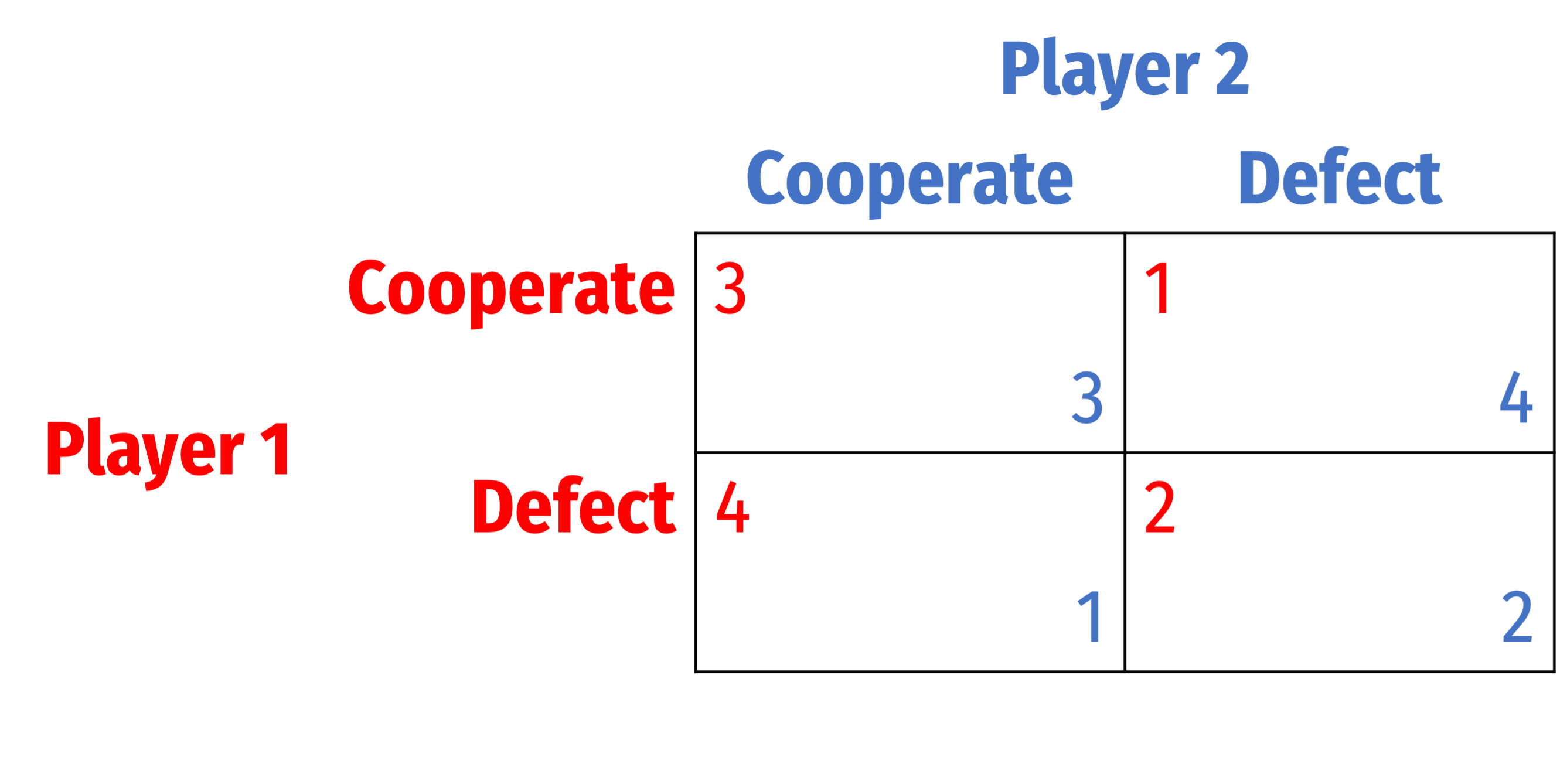

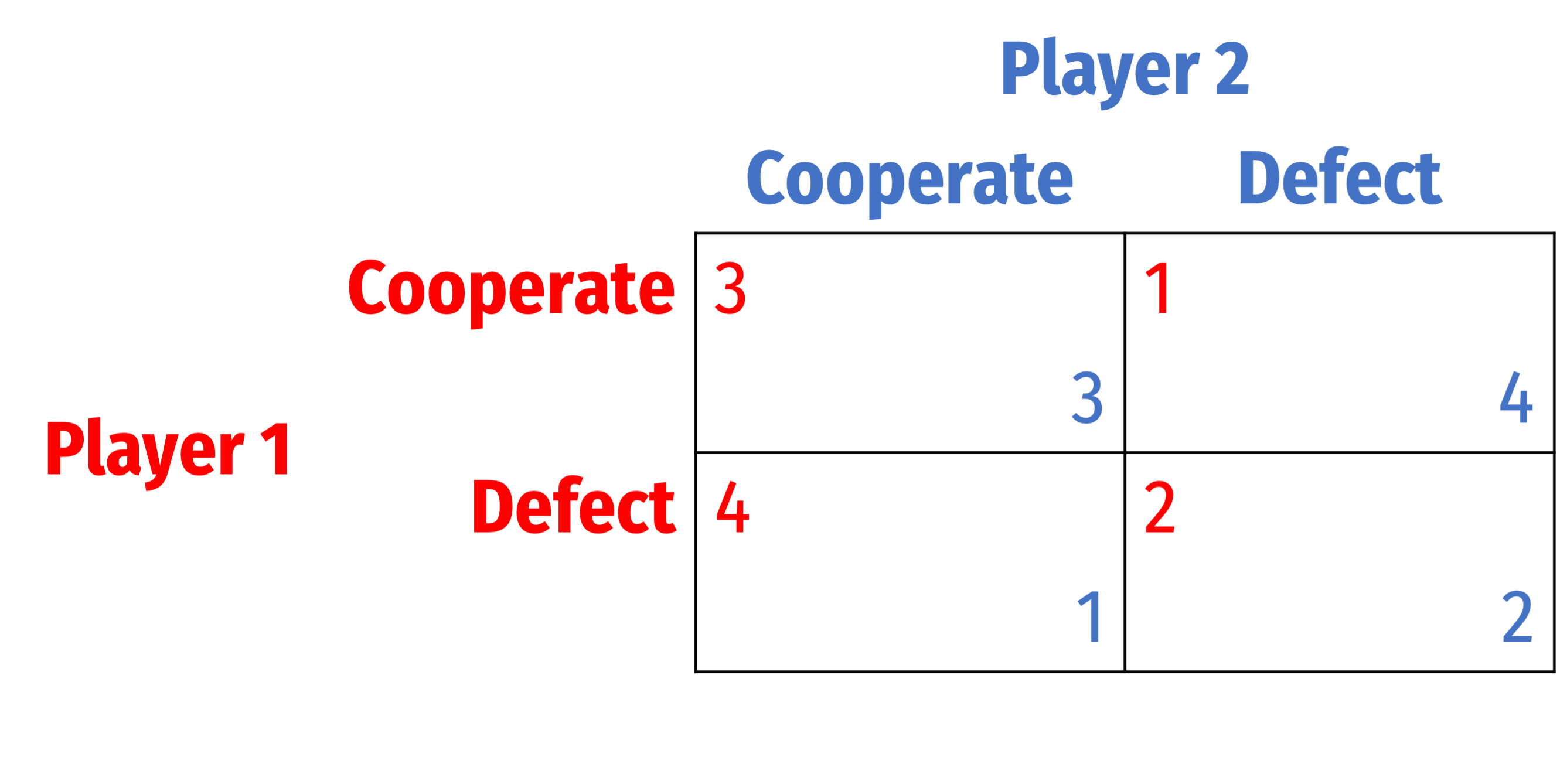

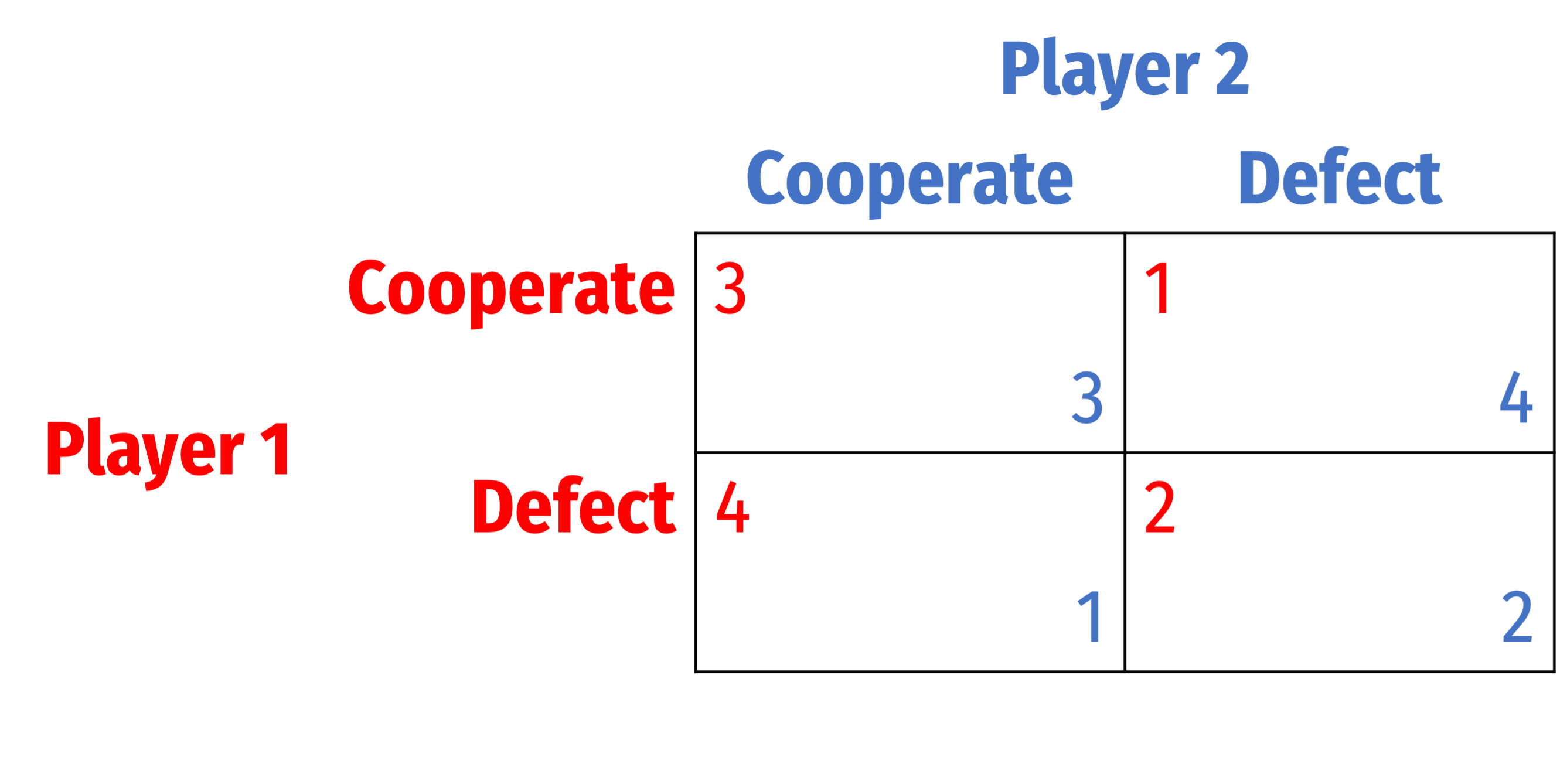

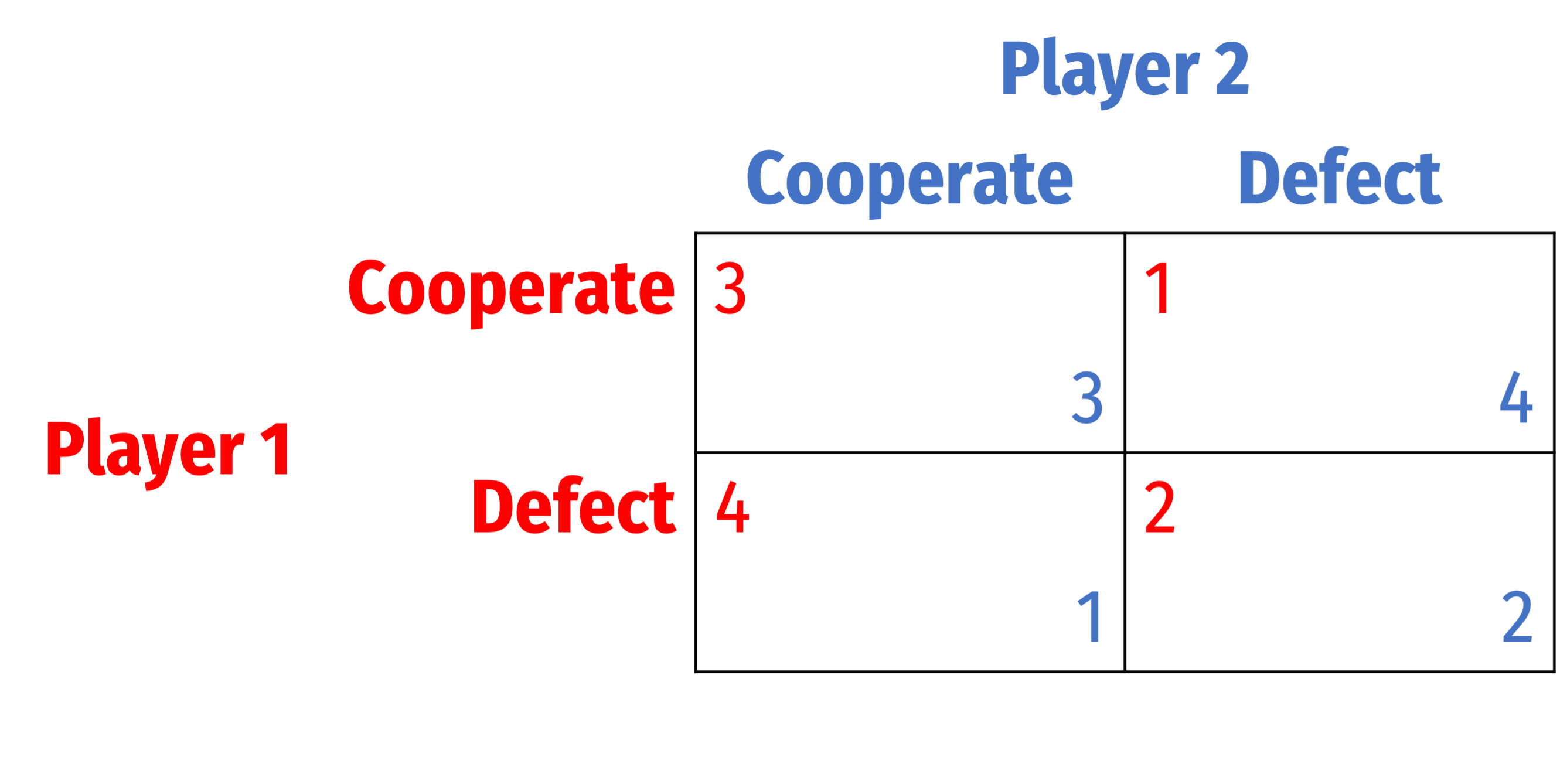

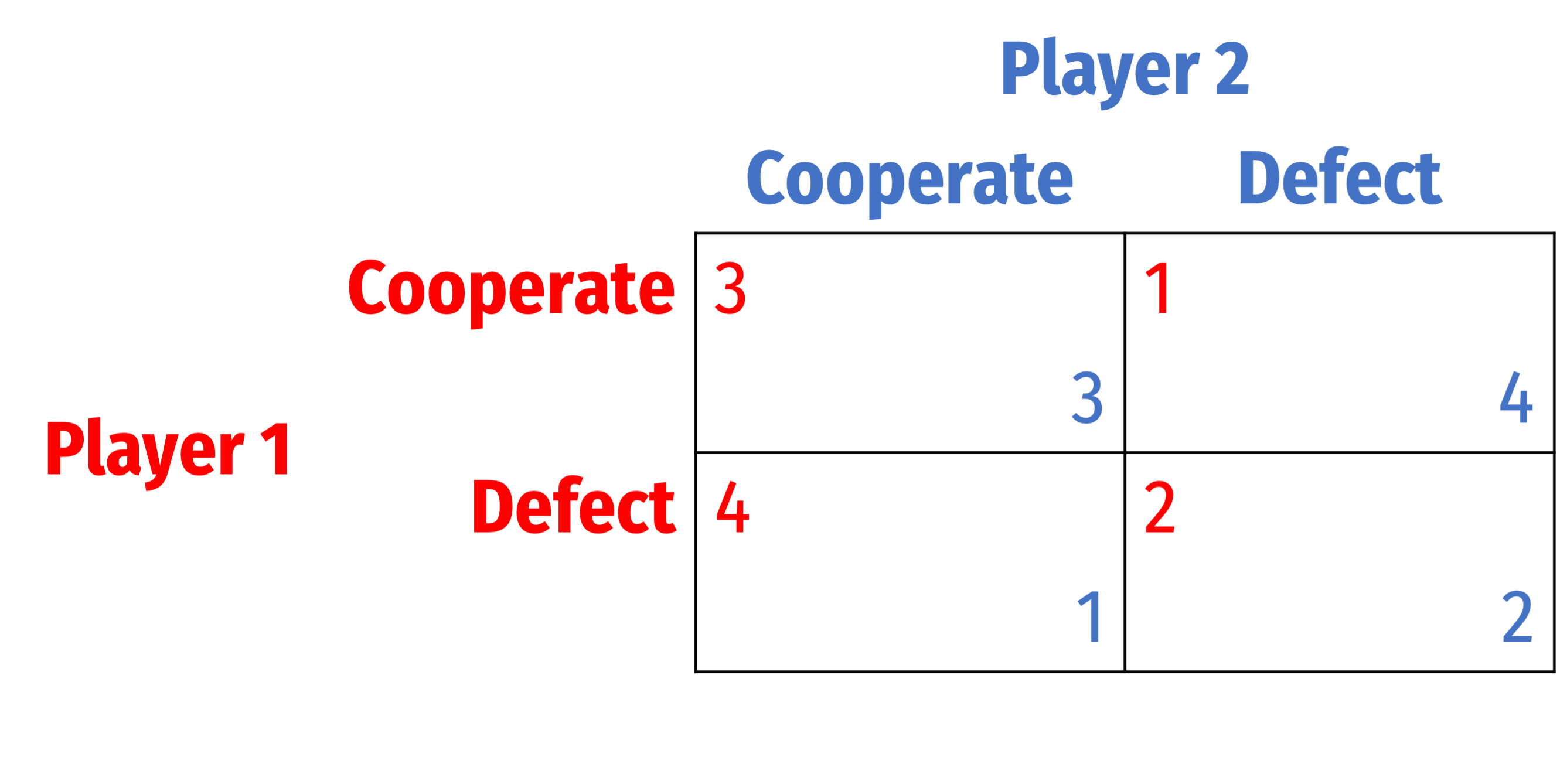

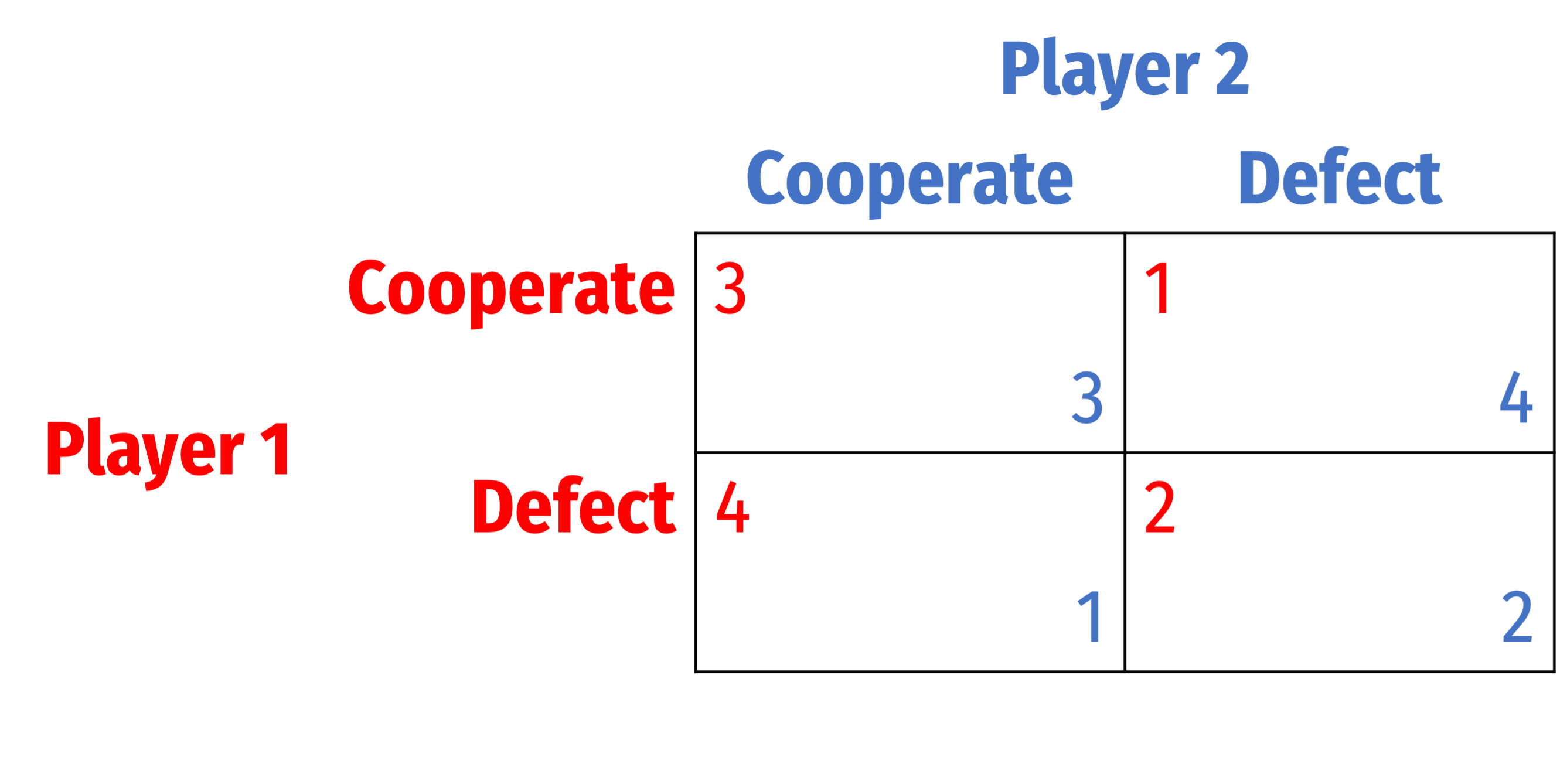

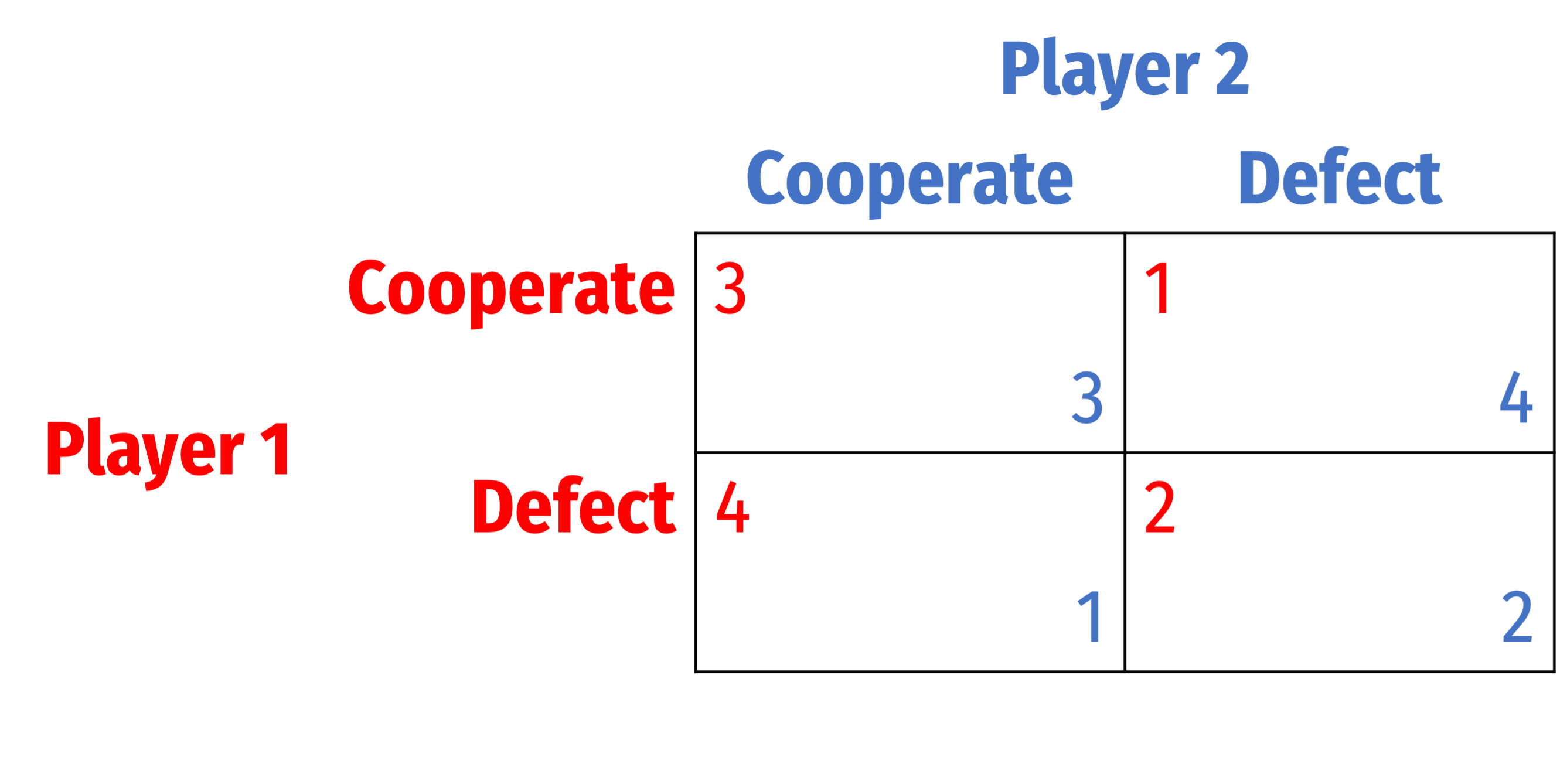

A true prisoners' dilemma: $$a>b>c>d$$

Each player's preferences:

- 1st best: you Defect, they Coop. ("temptation payoff")

- 2nd best: you both Coop.

- 3rd best: you both Defect

- 4th best: you Coop., they Defect ("sucker's payoff")

Nash equilibrium: (Defect, Defect)

- (Coop., Coop.) an unstable Pareto improvement

Prisoners' Dilemma: How to Sustain Cooperation?

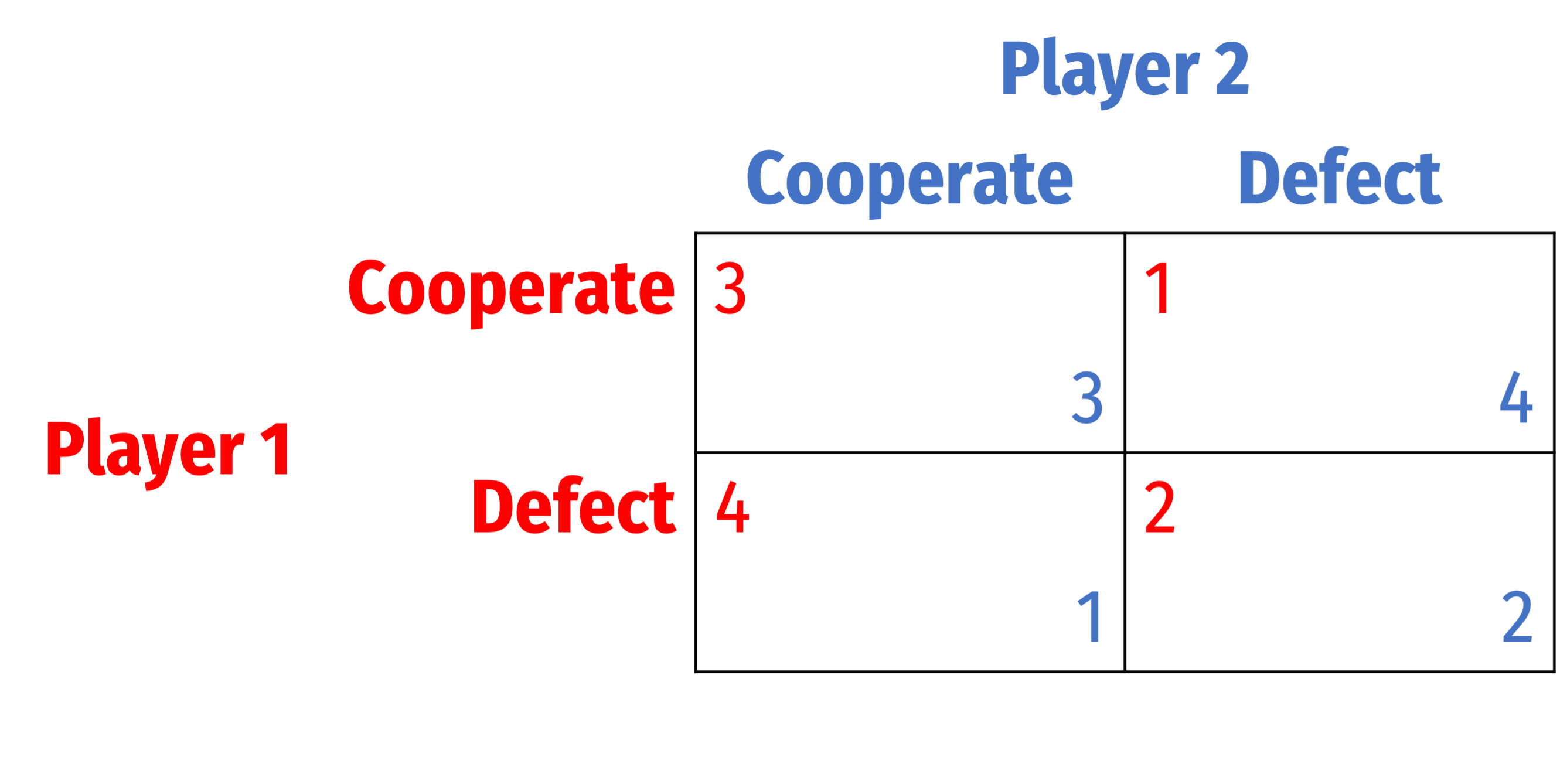

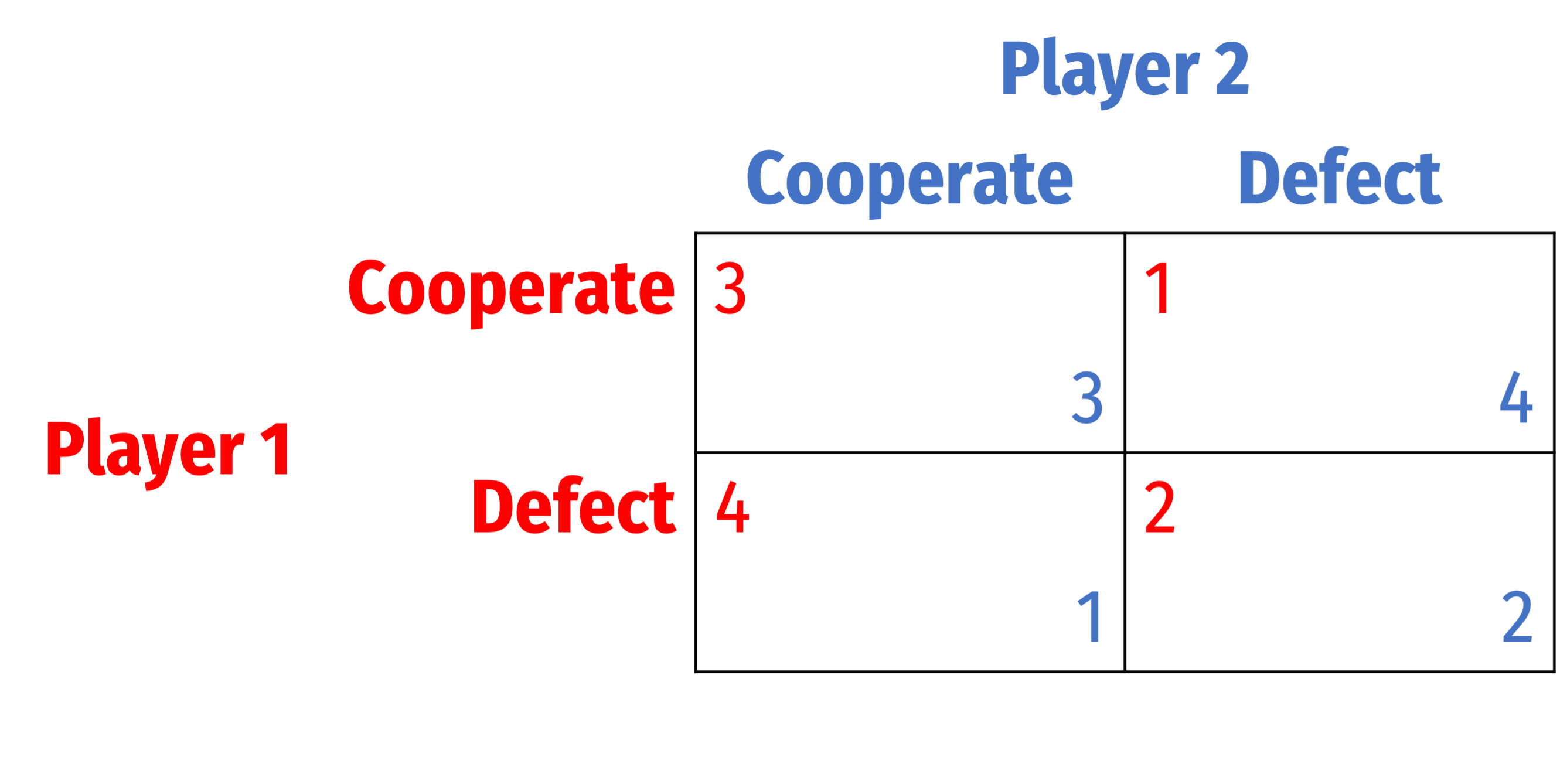

We'll stick with these specific payoffs for this lesson

How can we sustain cooperation in Prisoners' Dilemma?

Repeated Games

Repeated Games: Finite and Infinite

Analysis of games can change when players encounter each other more than once

Repeated games: the same players play the same game multiple times, two types:

Players know the history of the game with each other

Finitely-repeated game: has a known final round

Infinitely-repeated game: has no (or an unknown) final round

Finitely-Repeated Games

Finitely-Repeated Prisoners' Dilemma

Suppose a prisoners' dilemma is played for 2 rounds

Apply backwards induction:

- What should each player do in the final round?

Finitely-Repeated Prisoners' Dilemma

Suppose a prisoners' dilemma is played for 2 rounds

Apply backwards induction:

- What should each player do in the final round?

- Play dominant strategy: Defect

- Knowing each player will Defect in round 2/2, what should they do in round 1?

Finitely-Repeated Prisoners' Dilemma

Suppose a prisoners' dilemma is played for 2 rounds

Apply backwards induction:

- What should each player do in the final round?

- Play dominant strategy: Defect

- Knowing each player will Defect in round 2/2, what should they do in round 1?

- No benefit to playing Cooperate

- No threat punish Defection!

Finitely-Repeated Prisoners' Dilemma

Suppose a prisoners' dilemma is played for 2 rounds

Apply backwards induction:

Both Defect in round 1 (and round 2)

No value in cooperation over time!

Finitely-Repeated Prisoners' Dilemma

- For any game with a unique PSNE in a one-shot game, as long as there is a known, finite end, Nash equilibrium is the same

Finitely-Repeated Prisoners' Dilemma

- In experimental settings, we tend to see people cooperate in early rounds, but close to the final round (if not the actual final round), defect on each other

Infinitely-Repeated Games

Infinitely-Repeated Games

Finitely-repeated games are interesting, but rare

- How often do we know for certain when a game/relationship we are in will end?

Some predictions for finitely-repeated games don't hold up well in reality

- Ultimatum game, prisoners' dilemma

We often play games or are in relationships that are indefinitely repeated (have no known end), we call them infinitely-repeated games

Infinitely-Repeated Games

- There are two nearly identical interpretations of infinitely repeated games:

- Players play forever, but discount (payoffs in) the future by a constant factor

- Each round the game might end with some constant probability

First Intepretation: Discounting the Future

Since we are dealing with payoffs in the future, we have to consider players' time preferences

Easiest to consider with monetary payoffs and the time value of money that underlies finance

$$PV=\frac{FV}{(1+r)^t}$$

$$FV = PV(1+r)^t$$

Present vs. Future Goods

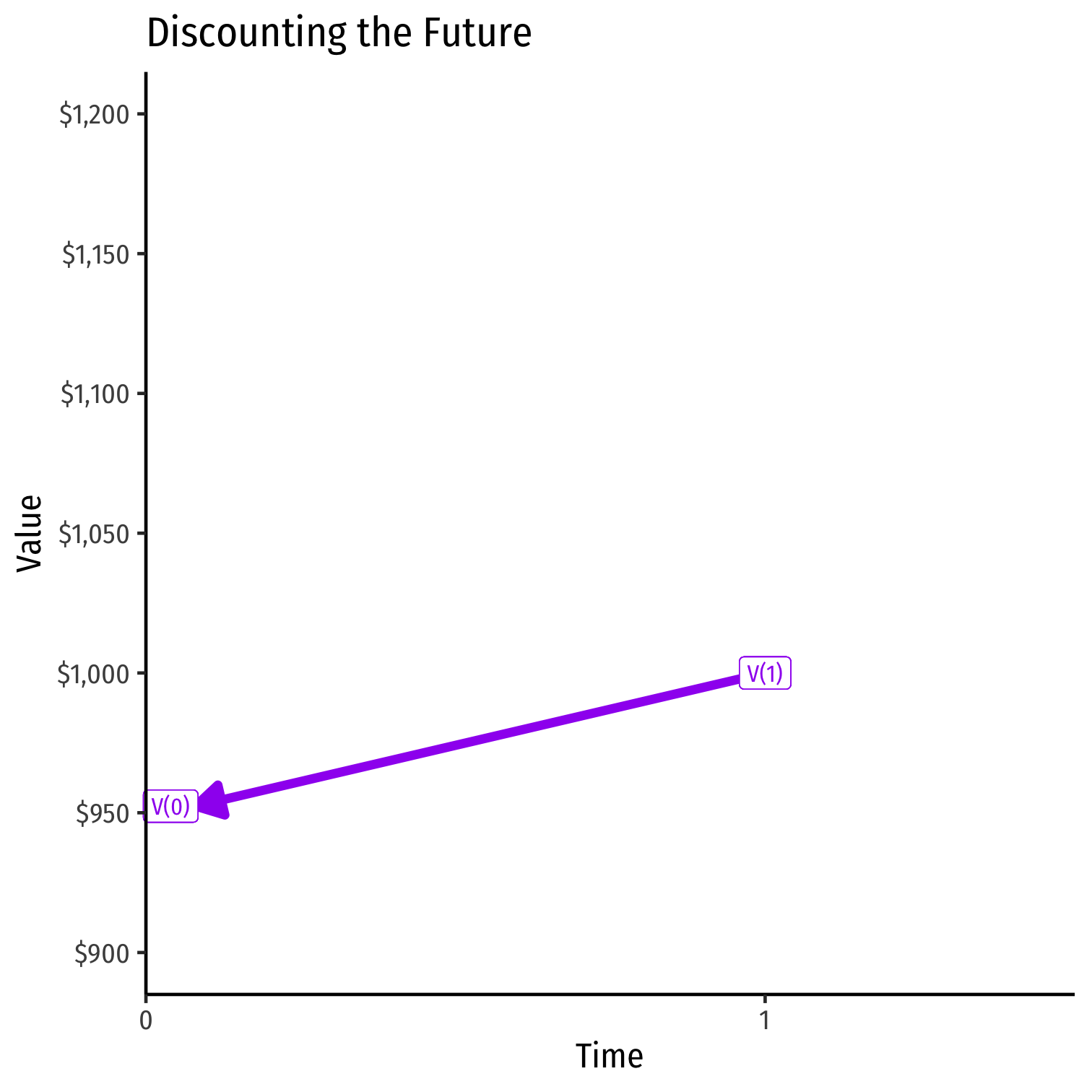

- Example: what is the present value of getting $1,000 one year from now at 5% interest?

$$\begin{align*} PV &= \frac{FV}{(1+r)^n}\\ PV &= \frac{1000}{(1+0.05)^1}\\ PV &= \frac{1000}{1.05}\\ PV &= \$952.38\\ \end{align*}$$

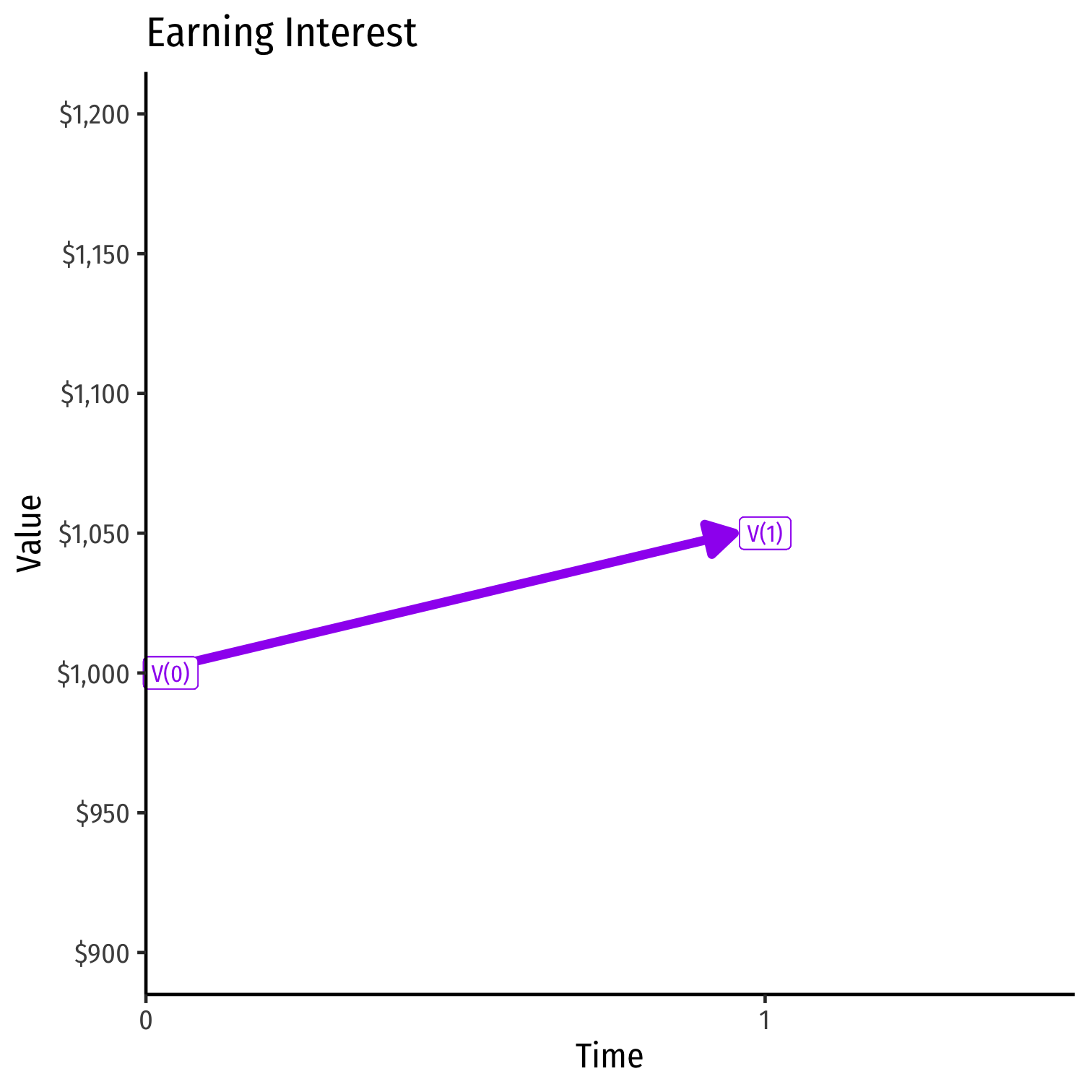

Present vs. Future Goods

- Example: what is the future value of $1,000 lent for one year at 5% interest?

$$\begin{align*} FV &= PV(1+r)^n\\ FV &= 1000(1+0.05)^1\\ FV &= 1000(1.05)\\ FV &= \$1050\\ \end{align*}$$

Discounting the Future

Suppose a player values $1 now as being equivalent to some amount with interest \(1(1+r)\) one period later

- i.e. $1 with an r% interest rate over that period

The “discount factor” is \(\delta=\frac{1}{1+r}\), the ratio that future value must be multiplied to equal present value

Discounting the Future

$$\$1 \text{ now} = \delta \, \$1 \text{ later}$$

If \(\delta\) is low \((r\) is high)

- Players regard future money as worth much less than present money, very impatient

- Example: \(\delta = 0.20\), future money is worth 20% of present money

If \(\delta\) is high \((r\) is low)

- Players regard future money almost the same as present money, more patient

- Example: \(\delta = 0.80\), future money is worth 80% of present money

Discounting the Future

Example: Suppose you are indifferent between having $1 today and $1.10 next period

Discounting the Future

Example: Suppose you are indifferent between having $1 today and $1.10 next period

$$\begin{align*} \$1 \text{ today} &= \delta \$1.10 \text{ next period}\\ \frac{\$1}{\$1.10} & = \delta\\ 0.91 &\approx \delta\\ \end{align*}$$

Discounting the Future

Example: Suppose you are indifferent between having $1 today and $1.10 next period

$$\begin{align*} \$1 \text{ today} &= \delta \$1.10 \text{ next period}\\ \frac{\$1}{\$1.10} & = \delta\\ 0.91 &\approx \delta\\ \end{align*}$$

There is an implied interest rate of \(r=0.10\)

$1 at 10% interest yields $1.10 next period

$$\begin{align*} \delta &= \frac{1}{1+r}\\ \delta &= \frac{1}{1.10}\ \approx 0.91\\ \end{align*}$$

Discounting the Future

- Now consider an infinitely repeated game

Discounting the Future

- Now consider an infinitely repeated game

- If a player receives payoff \(p\) in every future round, the present value of this infinite payoff stream is

$$p(\delta+\delta^2+\delta^3+ \cdots)$$

- This is due to compounding interest over time

Discounting the Future

- Now consider an infinitely repeated game

- If a player receives payoff \(p\) in every future round, the present value of this infinite payoff stream is

$$p(\delta+\delta^2+\delta^3+ \cdots)$$

- This is due to compounding interest over time

- This infinite sum converges to:

$$\sum_{t=1}^\infty=\frac{p}{1-\delta}$$

- Thus, the present discounted value of receiving \(p\) in every future round is \(\left(\frac{p}{1-\delta}\right)\)

Prisoners' Dilemma, Infinitely Repeated

- With these payoffs, the value of both cooperating forever is \(\left(\frac{3}{1-\delta}\right)\)

- Value of both defecting forever is \(\left(\frac{2}{1-\delta}\right)\)

Alternatively: Game Continues Probabilistically

Alternate interpretation: game continues with some (commonly known among the players) probability \(\theta\) each round

Assume this probability is independent between rounds (i.e. one round continuing has no influence on the probability of the next round continuing, etc)

Alternatively: Game Continues Probabilistically

Then the probability the game is played \(T\) rounds from now is \(\theta^T\)

A payoff of \(p\) in every future round has a present value of $$p(\theta+\theta^2+\theta^3+\cdots)= \left(\frac{p}{1-\theta}\right)$$

This is similar to discounting of future payoffs; equivalent if \(\theta=\delta\)

Strategies in Infinitely Repeated Games

Recall, a strategy is a complete plan of action that describes how you will react under all possible circumstances (i.e. moves by other players)

- i.e. "if other player plays \(x\), I'll play \(a\), if they play \(y\), I'll play \(b\), if, ..., etc"

- think about it as a(n infinitely-branching) game tree, “what will I do at each node where it is my turn?”

For an infinitely-repeated game, an infinite number of possible strategies exist!

We will examine a specific set of contingent or trigger strategies

Trigger Strategies

Consider one (the most important) trigger strategy for an infinitely-repeated prisoners' dilemma, the “Grim Trigger” strategy:

- On round 1: Cooperate

- Every future round: so long as the history of play has been (Coop, Coop) in every round, play Cooperate. Otherwise, play Defect forever.

“Grim” trigger strategy leaves no room for forgiveness: one deviation triggers infinite punishment, like the sword of Damocles

Payoffs in Grim Trigger Strategy

- If you are playing the Grim Trigger strategy, consider your opponent's incentives:

- If you both Cooperate forever, you receive an infinite payoff stream of 3 per round

$$3+3\delta+3\delta^2+3\delta^3+\cdots+3\delta^{\infty}=\frac{3}{1-\delta}$$

Payoffs in Grim Trigger Strategy

- This strategy is a Nash equilibrium as long there's no incentive to deviate:

$$\begin{align*} \text{Payoff to cooperation} & > \text{Payoff to one-time defection}\\ \frac{3}{1-\delta} & > 4+\frac{2\delta}{1-\delta}\\ \delta & > 0.5\\ \end{align*}$$

- If \(\delta > 0.5\), then player will cooperate and not defect

Payoffs in Grim Trigger Strategy

- \(\delta > 0.5\) is sufficient to sustain cooperation under the grim trigger strategy

- This is the most extreme strategy with the strongest threat

Payoffs in Grim Trigger Strategy

- Two interpretations of \(\delta > 0.5\) as a sufficient condition for cooperation:

- \(\delta\) as sufficiently high discount rate

- Players are patient enough and care about the future (reputation, etc), will not defect

- \(\delta\) as sufficiently high probability of repeat interaction

- Players expect to encounter each other again and play future games together

Other Trigger Strategies

- "Grim Trigger" strategy is, well, grim: a single defection causes infinite punishment with no hope of redemption

- Very useful in game theory for understanding the “worst case scenario” or the bare minimum needed to sustain cooperation!

- Empirically, most people aren't playing this strategy in life

- Social cooperation hangs on by a thread: what if the other player makes a mistake? Or you mistakenly think they Defected?

- There are “nicer” trigger strategies

"Nicer" Strategies

- Consider a "Forgiving Trigger" strategy:

- On round 1: Cooperate

- Every future round: so long as the history of play has been (Coop, Coop) in every round, play Cooperate. Otherwise, play Defect for 3 rounds

- Punishment, but lasts for 3 rounds, then reverts to Cooperation

"Nicer" Strategies

- Consider the "Tit for Tat" strategy:

- On round 1: Cooperate

- Every future round: Play the strategy that the other player played last round

- Example: if they Cooperated, play Cooperate; if they Defected, play Defect

"Nicer" Strategies

- Consider the "Tit for 2 Tats" strategy:

- On round 1: Cooperate

- Every future round: Cooperate, unless the other player has played Defect twice, then play Defect